| TGS insights give you the stories behind Energy data. These regular short 3-5 minute reads feature thought provoking content to illustrate the use of Energy data in providing insight, nurturing innovation and achieving success. |

Introduction

Deep sea mineral exploration in the search for metals and rare earth minerals (REMs) is presently a fledgling industry, but one that is exciting governments, a multitude of industries and financiers. Rare earth minerals are - and will be - essential for use in countless applications ranging from high-tech, clean energy, transportation and communications, to robotics, nanotechnology, medical equipment, antibiotics and medicine.

Looking specifically at its impact on the energy market, as energy transition pushes the industry toward electricity produced from variable sources such as solar and wind, more batteries will be needed for temporary storage. In the transport sector, electrification is happening fast with increased demand for a variety of metals, especially lithium, copper, cobalt and REMs. Though deep sea mineral extraction still has some environmental impact, it is seen as a truly viable alternative to controversial onshore mining which carries significant toxic pollution risks. Conversely, there are many aspects of the development plans for deep sea mining that make this attractive in comparison. For example, drilling technologies from the oil & gas industry can be used in conjunction with geothermal energy to run the production facilities. As such, deep-sea mining might fill the world’s need for battery metals in a less environmentally impactful way than its onshore equivalent.

Where could deep sea mining take place?

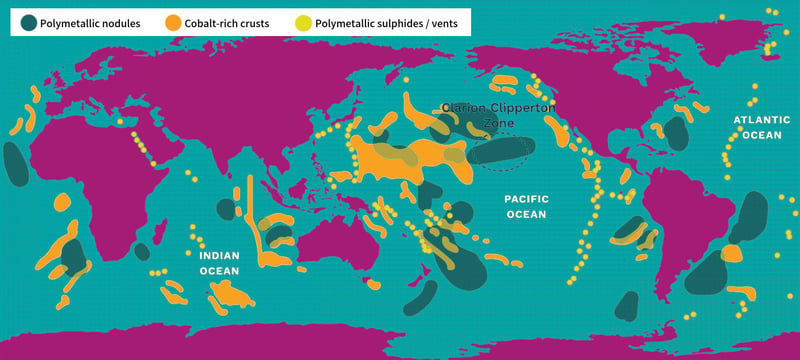

The world’s areas of volcanic activity are primarily concentrated around plate boundaries and subduction zones. Sulfide complexes - fertile grounds for metals and rare earth minerals - are particularly sited around spreading ridges or subduction zones at the plate boundaries. These complexes can exist anywhere there is ongoing volcanic, hydrothermal activity, as well as in subduction zones such as in the Far East. Further manganese nodule fields and metal-rich crusts sitting on hard ground are adding to the great potential for REMs in myriad locations right around the globe.

When compared to the fledgling oil industry in the early 20th century, this new mining industry will be highly scrutinized when it comes to environmental impacts. There have already been environmental concerns raised. Images of Pacific black smokers, with a rich ecosystem feeding off the mineral-rich water, are available. However, these active sulfide complexes will not be mined, as only extinct sites barren of macro-life will be open for mining. For this reason, public transparency will be a central part of the exploration work undertaken before any exploitation of deep-sea mining can take place.

What could be mined and where

Ocean mining sites are usually to be found around large areas of polymetallic nodules or active and extinct hydrothermal vents - and sited in 1.4 to 3.7 km of water depth. The vents create globular or massive sulfide deposits, which can then be mined using either hydraulic pumps or bucket systems that take ore to the surface to be processed.

With a history of pushing technological boundaries in the search for offshore resources, the oil and gas industry – from oil majors to service companies – is well place to contribute to the development of offshore mineral mining, though a financially viable industry is still some time off. However, the first technical and legislative steps are being taken. For example, in 2011, a Japanese research team discovered rare earth minerals on the seabed of the Pacific Ocean when testing soil samples from a number of locations at depths of between 3.5 and 6 km. It has been estimated that these deposits could contain up to 80-100 billion tons of REMs alone.

Recently, two important events have taken place which will affect the REM sector. The European Raw Materials Alliance was announced by the European Commission as part of a plan on Critical Raw Materials announced in September 2020. The European Raw Materials Alliance (ERMA) will be managed by EIT Raw Materials and overseen by the European commission in order to create a framework for secure and sustainable access to critical raw materials.

Initially, the focus will be on the rare earth value chains, after which it will extend to other raw materials which will be used to drive Europe’s green and digital transitions. Particularly important, will be a program to build public understanding and acceptance that critical raw materials will play a significant part in the transition to a thriving green economy.

The Norway movement

All over the world academia is mapping these modern-age riches, but so far only one country has opened for commercial mining - Norway. The country has recently passed a law that will eventually allow production and is planning the first licensing round in the coming years. The first area of exploration - and from where companies will be allowed to start production - is likely to be the Mohn’s Ridge in the middle of the North Atlantic between Iceland and Svalbard.

As of today, regulations state that it is only open for non-profit scientific work (academia). TGS filed a non-profit application via University of Bergen in the summer of 2020 for testing 3D seismic on known sulfide deposits at the Loki’s Castle. The company received the permit application, but unfortunately did not gain enough funding from a joint venture group consisting of academia, government, mineral companies and oil companies. Currently a thorough environmental assessment is being carried out and, if allowed, a licensing round is indicated for 2023.

Oil service players

In 2018 and 2019, The Norwegian Petroleum Directorate (NPD) completed a successful three-week data acquisition expedition on the Mohn’s ridge, with mapping carried out using an autonomous underwater vehicle (AUV), the Kongsberg Hugin. AUVs which are characterized by manoeuvrability and high accuracy of stabilization, will be a significant tool as the industry looks to open up deep sea mining around the world.

The oil industry has been supported over the decades by highly sophisticated methods and workflows for the subsurface mapping of oil and gas reservoirs. These methods can simply and effectively be utilized for marine mineral exploration with just minor adjustments in data acquisition, processing and interpretation techniques.

This year NPD did shallow drill holes and sampled known, extinct sulfide complexes. They used coil tube drilling technology from a ship and reported a successful cruise and many valuable samples and cores was brought on shore for further analysis. In one place they report up to 12% copper and 3 % cobalt, very rich ore just below the seafloor.

A future for deep sea mining?

TGS experts hold a strong technical belief that the latest 3D seismic acquisition and imaging technologies would be the geophysical tool of choice for Mohn Ridge and beyond. TGS is optimistic that the Norwegian Government will legislate to create a license round for deep sea mining in Norwegian waters by 2023 which can become a blueprint that other countries to open their deep-water areas. There is strong political pressure today to open the world’s mid-ocean ridges for commercial mining activity. However, most of the spreading ridges - which look to be most favorable for mining - are regulated by the UN and there is not yet much movement in this direction. Countries in the Far East may be the first ones to follow Norway - Papua New Guinea almost allowed underwater mineral exploration company, Nautilus, to start productions before environmental protests in Australia halted financing. If drilling technology and geothermal energy supply should prove itself in Norway, this situation and other potential developments around the world, could well gain traction.