Subsurface Insight Ahead of the Newfoundland 2024 Call for Bids

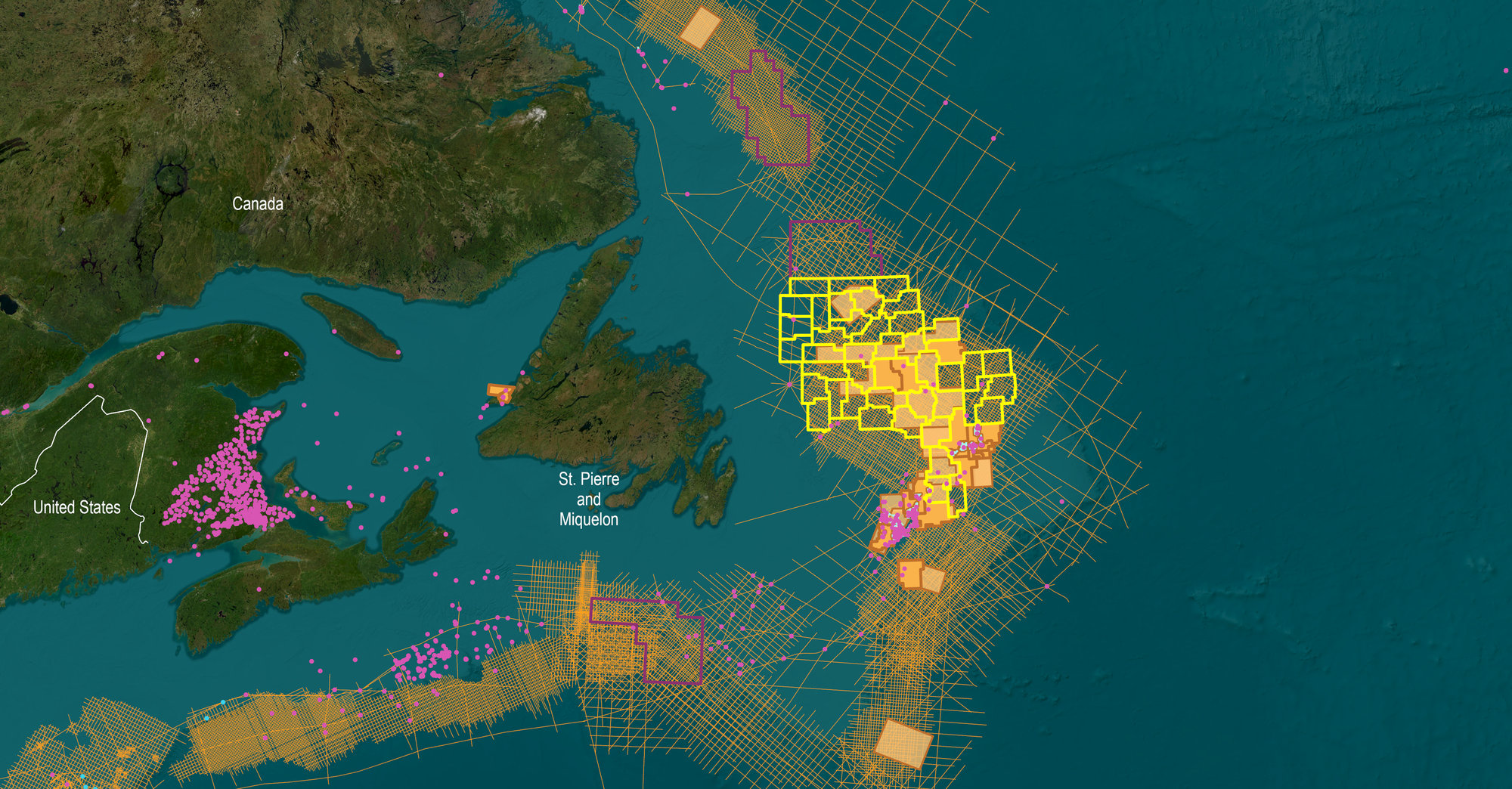

We offer the most extensive subsurface data collection for the 2024 bid round areas, featuring high-quality 2D and 3D seismic data, interpretation studies and well data.

East Coast Canada Newfoundland

2024 Call for Bids

The Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) has issued a Call for Bids for Exploration Licences in the Eastern Newfoundland Region.

Call for Bids No. NL24-CFB01 (Exploration Licences, Eastern Newfoundland Region) consists of 41 parcels and a total of 10,287,196 hectares, 32 of which have been made available under previous Calls for Bids or relinquishment of lands that have subsequently reverted back to Crown reserve. The remaining nine parcels are new and were designed over Sector NL06-EN, with consideration given to stakeholder input from a previous call for nominations.

Interested parties will have until 12:00 p.m. Newfoundland time on November 6, 2024 to submit sealed bids for the parcels offered in this Call for Bids.

Data-Driven Exploration

TGS, in partnership with PGS, holds the most comprehensive collection of subsurface data across acreage offered in the Newfoundland and Labrador 2024 Call for Bids. Our data coverage for the newly announced parcels comprises ~67,000 km of 2D seismic data, ~38,000 km2 of 3D seismic data, interpretation studies and well data.

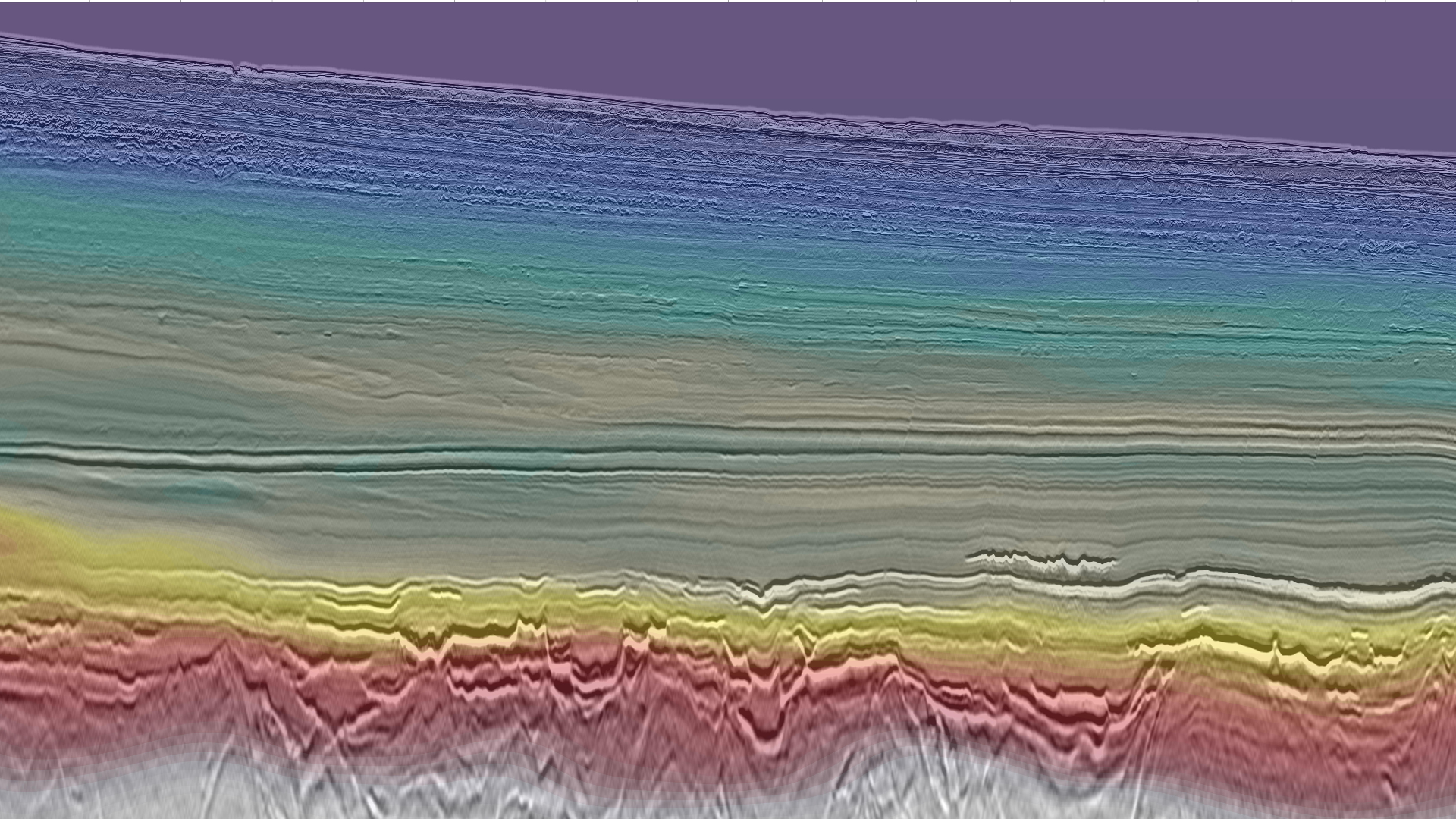

The Long Range 3D, Tablelands 3D, N. Tablelands 3D, NE Newfoundland 3D, Cape Anguille 3D, South Flemish Pass 3D and the Harbour Deep 3D cover highly prospective parcels in the Eastern Newfoundland bid round area and the 2024 South Eastern Newfoundland bid round area. Also, a comprehensive 5X5 km grid covers highly prospective parcels of the 2024 South Eastern Newfoundland bid round area. The 2D and 3D surveys were acquired utilizing the PGS Broadband Geostreamer Technology with 8,100 meters of offsets, providing high quality imaging.

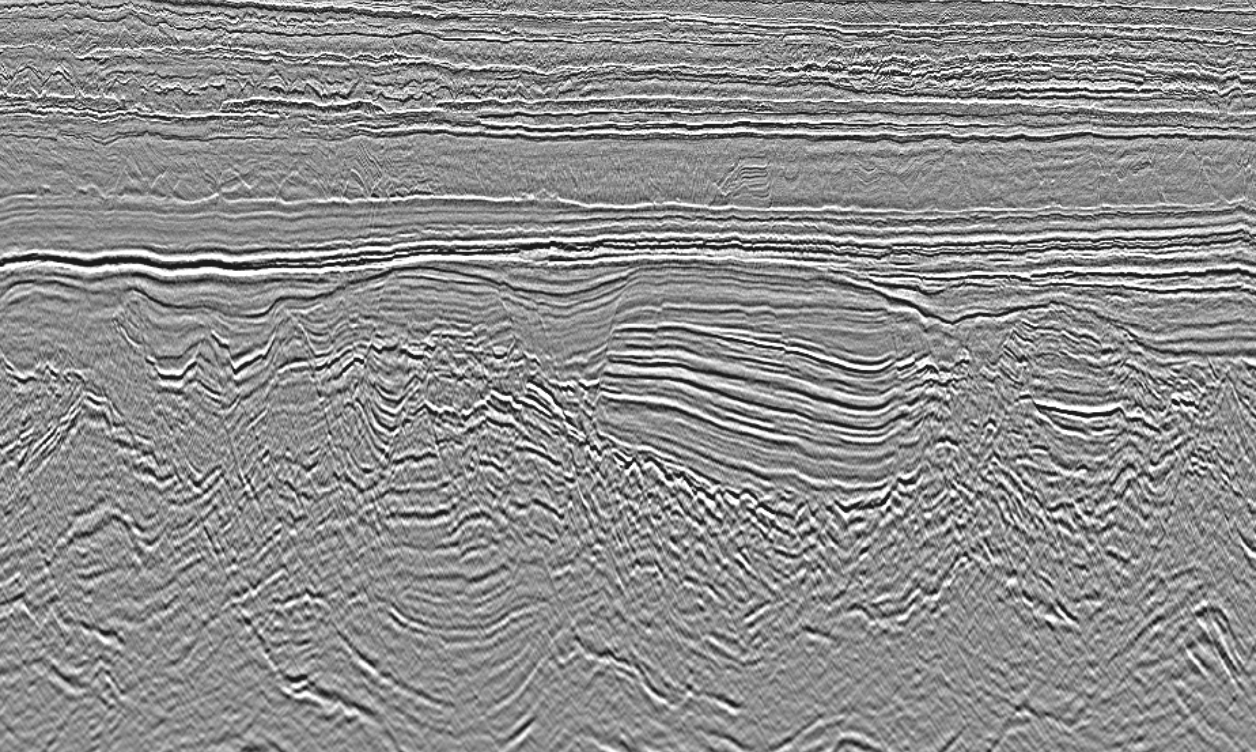

Harbour Deep 3D

Harbour Deep 3D lies just east-northeast of the prolific Jeanne d'Arc Basin. This long offset encompasses numerous exploration licenses, significant discovery licenses, and portions of the open acreage offered in the Newfoundland bid rounds.

The acquisition of data was conducted by PGS’ Ramform Atlas, employing their cutting-edge high-resolution Geostreamer® technology. This dataset offers a modern and comprehensive HD3D dataset, covering a significant portion of the acreage within Offshore Canada's sole producing region.

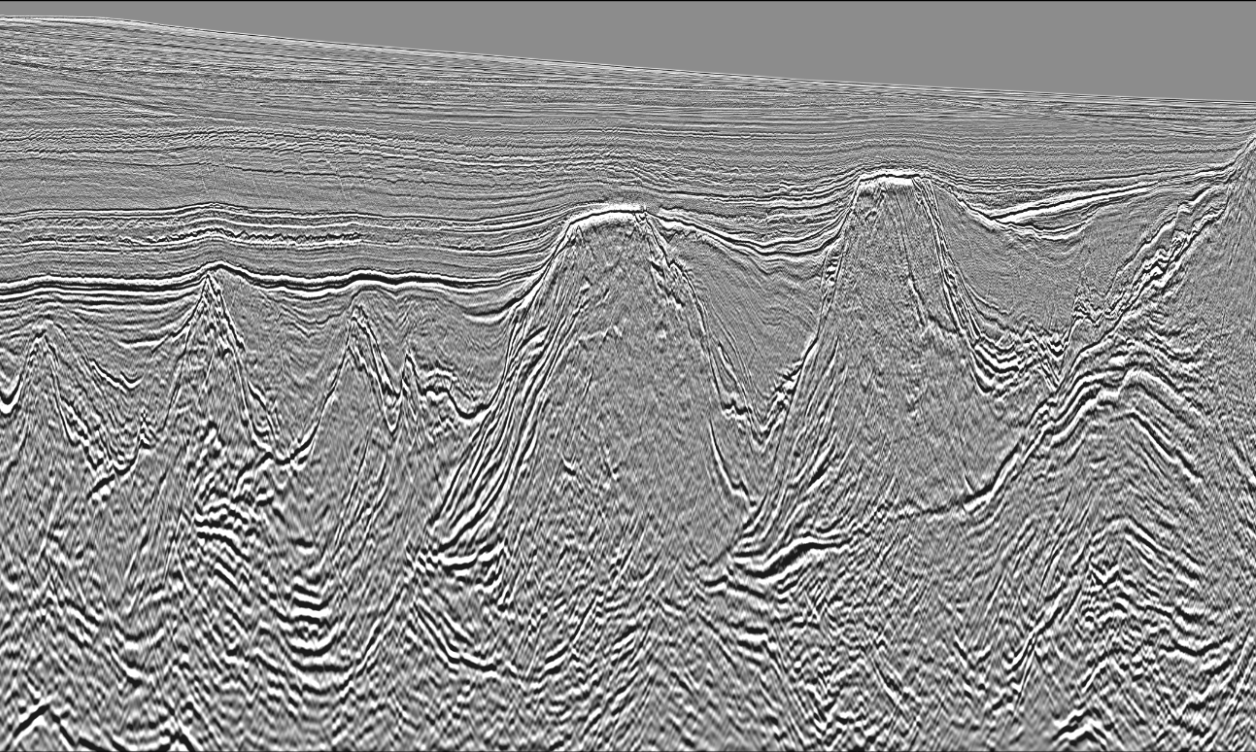

Cape Anguille 3D

This program expands the TGS-PGS joint venture with an additional 10,000 square kilometers of 3D coverage offshore Newfoundland.

The survey covers existing lease blocks and open acreage in the prospective Orphan Basin. The Orphan Basin has, among others, potential Cretaceous and Tertiary infill depocentres. The data was acquired and processed and includes Kirchhoff 3D PSTM volumes. The 3D volume was acquired with long offsets utilizing Geostreamer® technology.

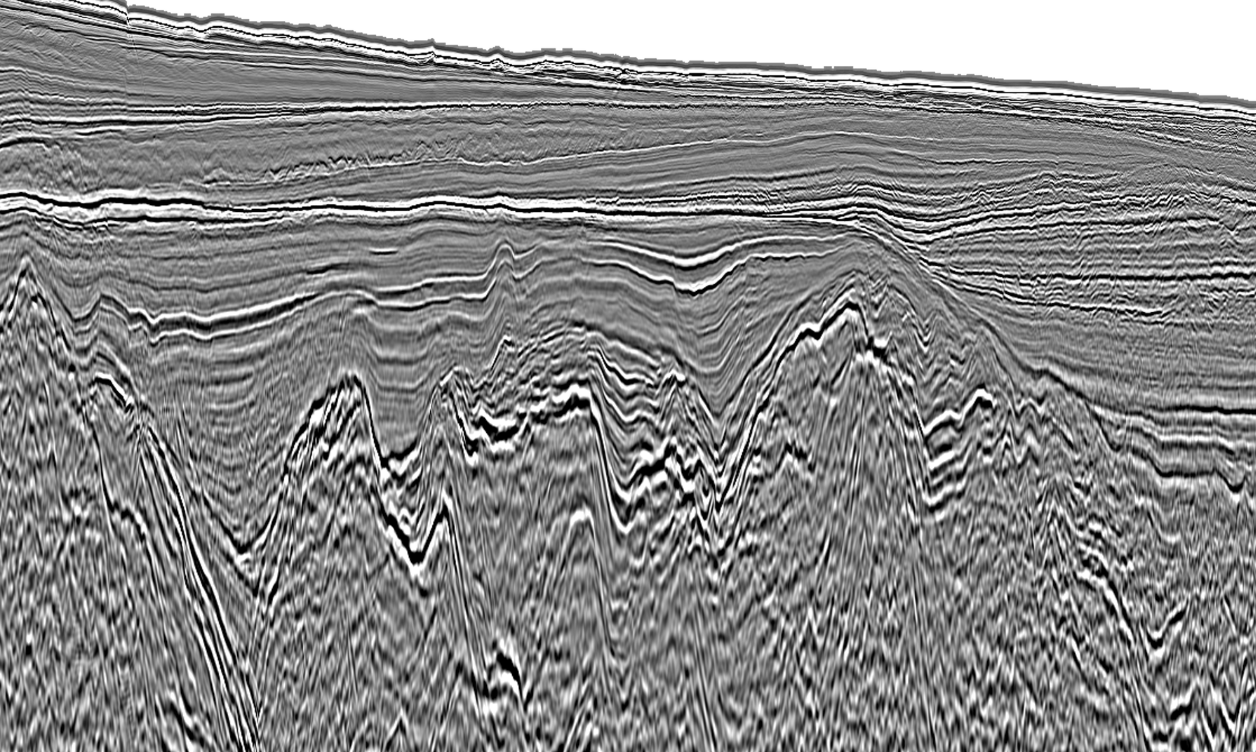

Regional SPAN Data

TGS’ GrandSPAN, and LabradorSPAN 2D seismic programs provide ~87,000 km of regional context to the 2024 license round acreage, offering insights for the evaluation of source rock and reservoir potential.

The consistent velocity model and suite of angle stacks help highlight clastic leads from Cretaceous to Tertiary sedimentary units. Complemented by more closely spaced 2D seismic grids, the basin framework provides a foundation of subsurface knowledge directing exploration teams to the most prospective blocks.

Evaluate Exploration Opportunities with Well Data

TGS provides high-quality processed and conditioned well data that enhances geological insights in the Newfoundland bid round areas, empowering E&P companies to optimize their strategies in the region by mitigating exploration risks and capitalizing on potential opportunities.

.png?width=1256&height=752&name=TGS_East%20Coast%20Canada%20Bid%20Round_Well%20Data%20(2).png)

New Incentives for Seismic and Drilling Expenditure

C-NLOPB has announced that the percentage of pre-bid seismic spend that will be refunded from the winning bidder’s security deposit has increased, threefold, to 75% of allowable expenditure. These amendments will provide greater certainty regarding drilling-related overhead costs and create administrative efficiencies for submitting and reviewing applications for allowable expenditure credit received from interest owners. Click here to learn more about these updates.

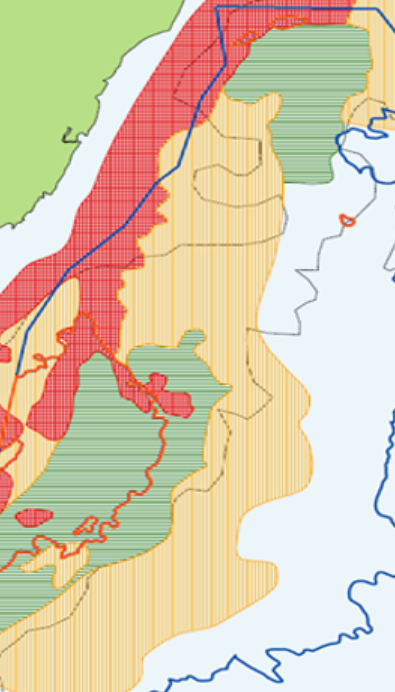

Prospectivity Insight: East Canada Facies Map Browser and Play Fairway Analysis

TGS' comprehensive collection of subsurface data and interpretation products library in East Canada are an invaluable resource. Access to seismic surveys, standardized well data, and detailed interpretations allows companies to accelerate basin evaluation for bid round analysis and provide the regional context to support asset-focused teams.

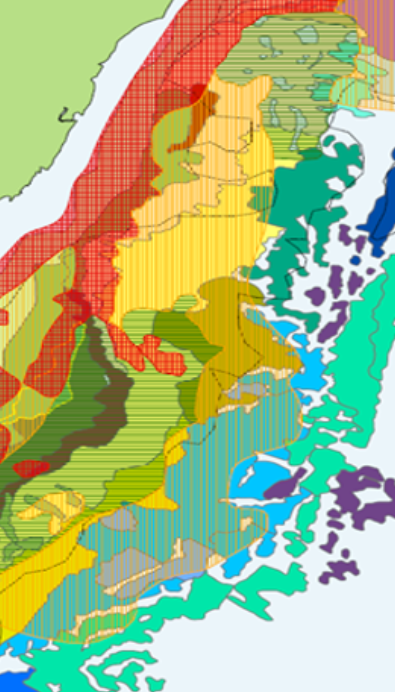

Facies Map Browser (FMB) is the result of a multi-year study that utilized all available datasets, making it the most comprehensive multi-client interpretation offered for the region, and the only one of its kind. Our expert geoscientists have extended and updated the stratigraphic model to cover the entire offshore East Canada, including Labrador, Newfoundland and Southeast Grand Banks.

The FMB provides users with desktop access to an integrated data suite and subsurface insights covering acreage in the upcoming bid rounds. The study makes available the processed wireline data for released E&A wells, a shows database, interpreted stratigraphy, lithology, core descriptions, environment and facies associations, as well as maps of gross depositional environment, source, reservoir, seal, and play risk. Additional seismic interpretation deliverables and reports detailing results from complementary potential fields and basin thermal modeling studies are available.

Speak to a Specialist

Let us know your needs and we’ll connect you to the right person or team.

Book a Data Viewing

Want to see the latest seismic data solutions and imaging technologies in your region of interest or for the next license round? Book a data viewing with one of our experts.

Discuss your Seismic Data Needs

Every need is different and we'd like the opportunity to discuss yours further. Speak to one of our data or geoscience experts to customize seismic solutions specific to your requirements.