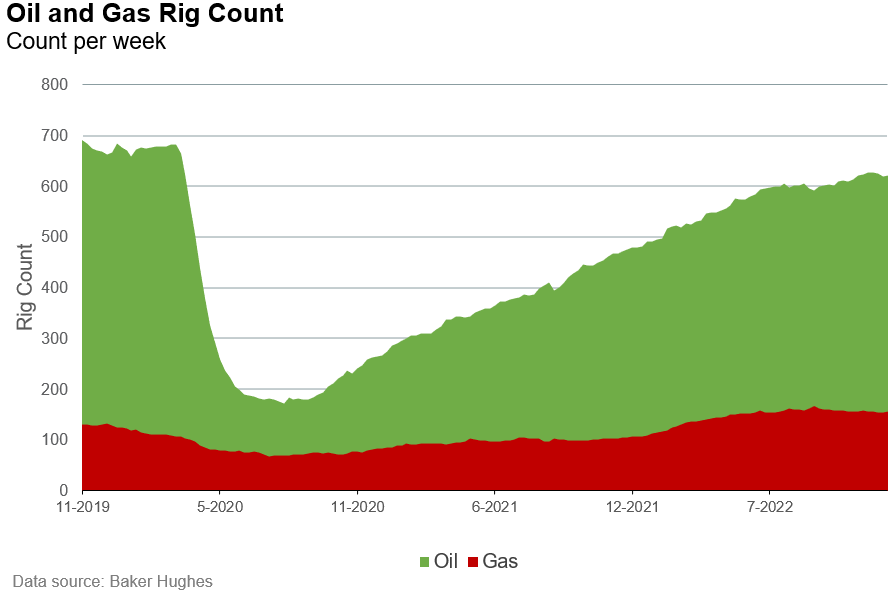

U.S. natural gas drilling rigs exceeded pre-pandemic levels by over 20% in 2022.

U.S. oil drilling rigs continue to fall behind approximately 8% pre-pandemic levels. In contrast, U.S. gas drilling rigs have exceeded pre-pandemic levels by over 20%. The higher level of rig activity in gas basins in 2022 has translated into increased gas production. As of September 2022, U.S. dry natural gas production was short of 3 Tcf, according to TGS.

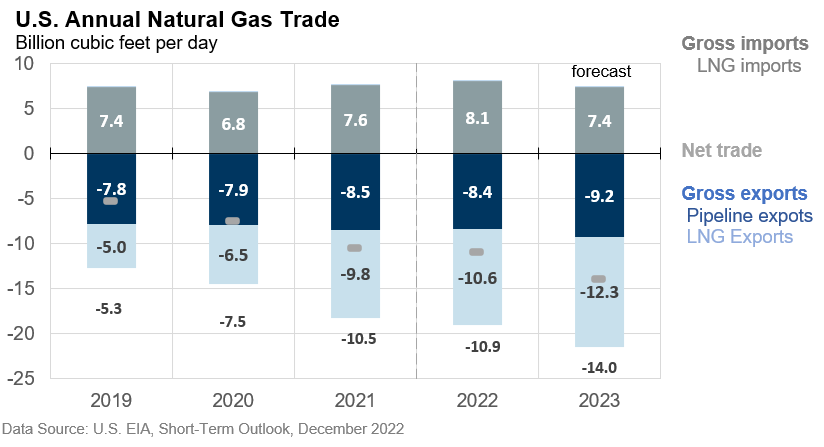

There are several reasons for gas operators' willingness to increase production. To begin with, according to the 2022 BP Statistical Review, natural gas demand is at an all-time high, surpassing the previous record set in 2019. Moreover, international gas prices have remained 3 to 5 times higher than U.S. prices at Henry Hub, presenting a clear opportunity for operators to monetize. U.S. gas exports via liquified natural gas (LNG) achieved record levels in 2022, fueled by Russia's invasion of Ukraine. In 2023, the U.S. is expected to continue exporting gas by pipeline and as LNG with a net traded volume of 14.1 Bcf/d.

Natural gas futures contracts were down in early trading Tuesday, suggesting a bearish look for the commencement of 2023. Lighter than usual natural gas demand throughout the month of January is expected, according to the NatGas demand forecast. For this week, the website cites: "Warmer than normal conditions will rule the southern and eastern U.S. most of the next 7-days with highs of the 40s to 60s across the Great Lakes, Ohio Valley, and Northeast and very nice 60s to lower 80s over the southern U.S. and up the Mid-Atlantic Coast for very light national demand. There will be a minor bump in demand late in the week as a rather mild weather system exits the West and tracks across the eastern half of the U.S.”