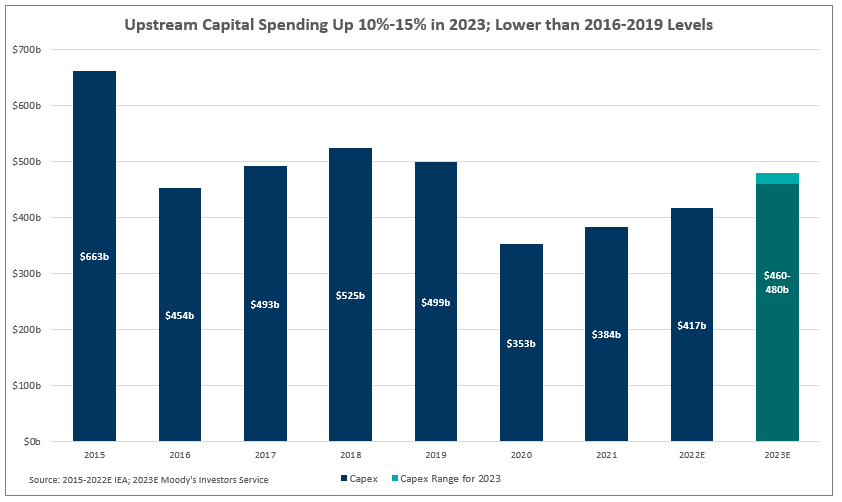

Even though global upstream spending will increase in 2023 by 10 to 15%, overall spending still stumbles down from the 2016-2019 levels.

Upstream companies raised their capital expenditure budgets for 2023 after closing a year that allowed them to generate unprecedented free cash flows. The rebound in oil and gas prices in 2022 and capital discipline exercised in the previous years permitted many companies to reduce debt and return capital to shareholders through dividends and share buyback programs.

According to Moody's latest research note, this year's global upstream spending will increase by about 10 to 15%. Over half of the gradual increment in expenditures in 2023 will cover cost inflation, while the remainder will finance volume growth projects. In the note, Sajjad Alam, vice president at Moody's, expressed: "While we expect average prices to stay above mid-cycle levels in 2023, we also anticipate a high degree of price volatility in a delicately balanced global energy market. Various factors will constrain oil and natural gas supplies, while demand growth will waver because of increased recession risks and shifting policies in the largest energy-consuming nations. Sharp price swings will remain a norm, making large or long-term capital investment decisions difficult for companies".

In a recent Dallas Federal Reserve energy survey, where 148 oil and gas companies' executives were interviewed, 25% of respondents said their companies would significantly increase the capital expenditure budget for 2023. Similarly, 39% of executives assured capital spending would rise slightly. Another 22% said spending in 2023 will reflect 2022 levels. Only 14% of respondents expect a decrease in spending in 2023.

North American oil majors, likewise, are planning to increase capital spending budgets in 2023. Chevron recently announced an allocation of USD$17 billion this year, up more than 25% from the 2022 expected levels, around USD$4 billion for Permian Basin development, and approximately USD$2 billion for other shale and tight assets in the U.S. The budget assigned to Gulf of Mexico projects accounts for over 20% of the upstream capex budget.

Comparably, Exxon Mobil plans to maintain capex between USD$20 - USD$25 billion for the year. More than 70% of capital investments will be deployed in the U.S. Permian Basin, Guyana, Brazil, and LNG projects worldwide. The company has consistently communicated capital spending plans to investors, with numbers remaining practically unchanged since the beginning of 2022.

The average global upstream spending from 2016 to 2019 was approximately USD$493 billion annually. Post-COVID, however, average spending in the sector has been reduced to USD$422 billion per year. While there is a clear need for investment in oil and gas projects to provide energy security in the future, the industry certainly needs help securing additional funding for investments. As laid out by Christyan Malek, JP Morgan head of Energy Strategy: "Oil is where we see the greatest need for incremental investment, both in sustaining the existing production base as well as growing it … while we are seeing the recognition of the need for investment into oil and gas, it hasn't translated yet to actual additional spending."