The acquisition of QuarterNorth Adds Significant, Immediate Production and Reserves to Talos Energy’s Growing GOM Portfolio.

On Monday, Talos Energy announced an agreement to acquire QuarterNorth Energy for $1.29 billion. The deal is structured to be financed primarily through cash ($965 MM), with the remaining transaction amount made up by 24.8 million new shares of Talos common stock. The acquisition of QuarterNorth, combined with the previous acquisition of EnVen Energy in 2022, sets Talos Energy up as a key strategic player in the Gulf of Mexico.

Talos, in their QuarterNorth acquisition announcement presentation, lists key strategic criteria where the QuarterNorth transaction compares favorably:

- Strategic Fit

- Complementary Asset Portfolio

- Attractive Financial Profile

- Accretive to Key Metrics

- Preservation of Credit Strength

- Scale and Diversity Benefits

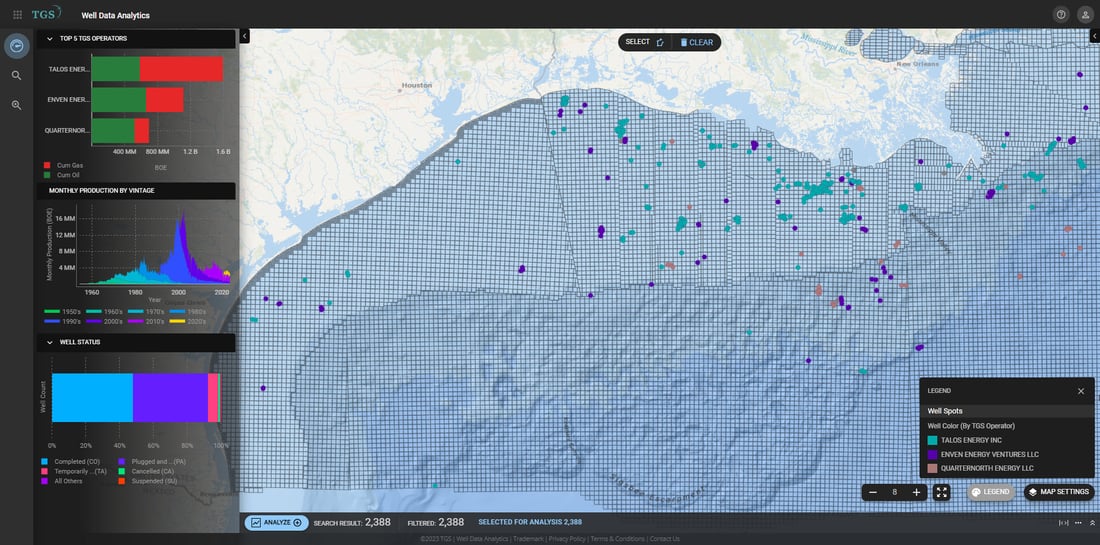

Figure 1 shows how existing QuarterNorth wells align with Talos Energy (including EnVen Energy) wells to create that Complementary Asset Portfolio with “overlapping deepwater footprint with valuable operated infrastructure”.

Figure 1: Talos Energy and QuarterNorth Energy Positions in GOM

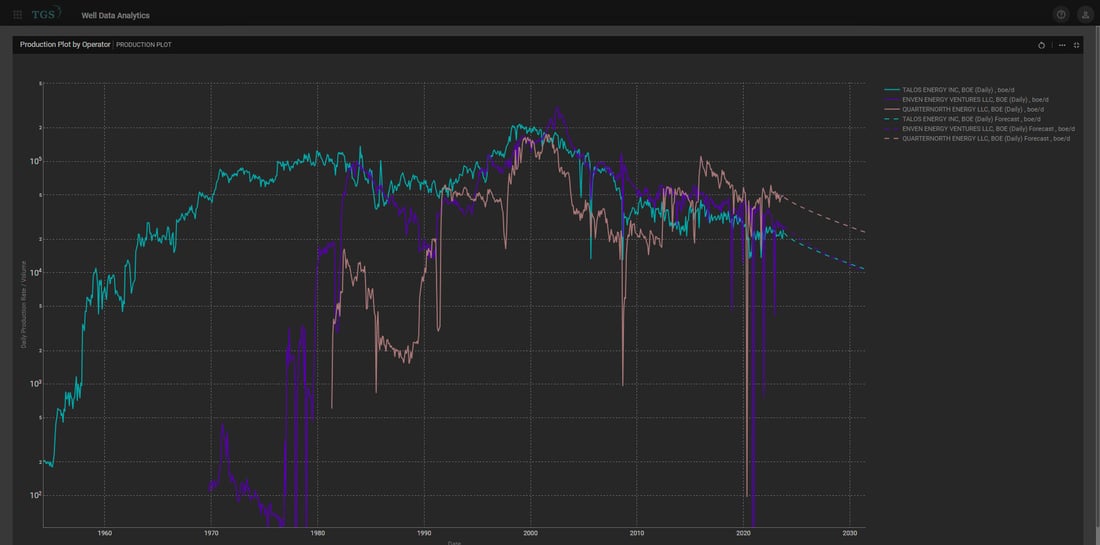

Figure 2 shows overall operated production from each entity, highlighting strong daily production from QuarterNorth assets at nearly 50 MBOE/D. Talos sees this as key to their Strategic Fit, with “sizeable production” already active and “high-quality inventory” for additional development.

Figure 2: Operated Production Comparison by Operator

Figure 3 compares type-well profiles from each entity. Key takeaways include that QuarterNorth wells on average outperform legacy Talos wells on ultimate recovery and decline rate, and also tend to be earlier life wells.

Figure 3: Type-Well Production Profile Comparison by Operator.

In summary, the acquisition of QuarterNorth Energy provides Talos Energy with immediate cashflow from high-performing assets, high-quality inventory for additional development opportunities, and synergies in infrastructure and operations.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.