Deal makes Matador a top Permian producer, setting the stage for further upstream M&A and A&D activity in 2023

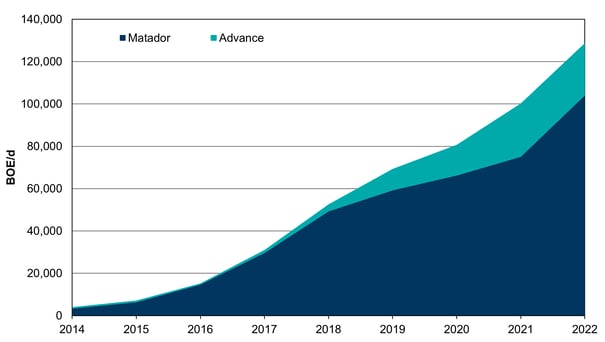

Matador Resources announced the purchase of Advance Energy Partners on Tuesday, potentially marking the beginning of an active year of consolidation among the upstream oil and gas sector. The acquisition of 18,500 acres across Loving, Ward, Lea and Eddy counties in the northern Delaware Basin are expected to raise production 24% to nearly 130,000 BOE/d (TGS Well Performance Dataset), cementing Matador as a top Permian producer.

Matador’s acquisition follows $3 billion and $1.4 billion Eagle Ford divestures by Ensign and Chesapeake, respectively. It has also been reported that HighPeak Energy, Ranger Oil, and Berry Corporation are exploring possible sales. Although mostly quiet in 2022, Permian consolidation, primarily involving independents, is expected to grow significantly in 2023. Kickstarting the 2023 year is a $4.8 billion merger of Brigham Minerals and Sitio Royalties.

Coupled with high equipment and labor costs, independents struggle to maintain current production rates, becoming M&A targets for supermajors to replenish their shale inventories. Largely on the sidelines over the past three years, supermajors are expected to reach $150 billion in earnings for 2023 after a record setting year of $200 billion in 2022, while independents have seen a marked decrease over the back half of 2022. Continuing investor pressure for capital discipline and unseen price volatility continue to remain key obstacles, but 2023 is shaping up to be a significant year of consolidation for upstream E&Ps.

Source: TGS Production Data – January 25, 2023