The planned combination will create the fifth-largest Permian producer with nearly 838 Mboe/d.

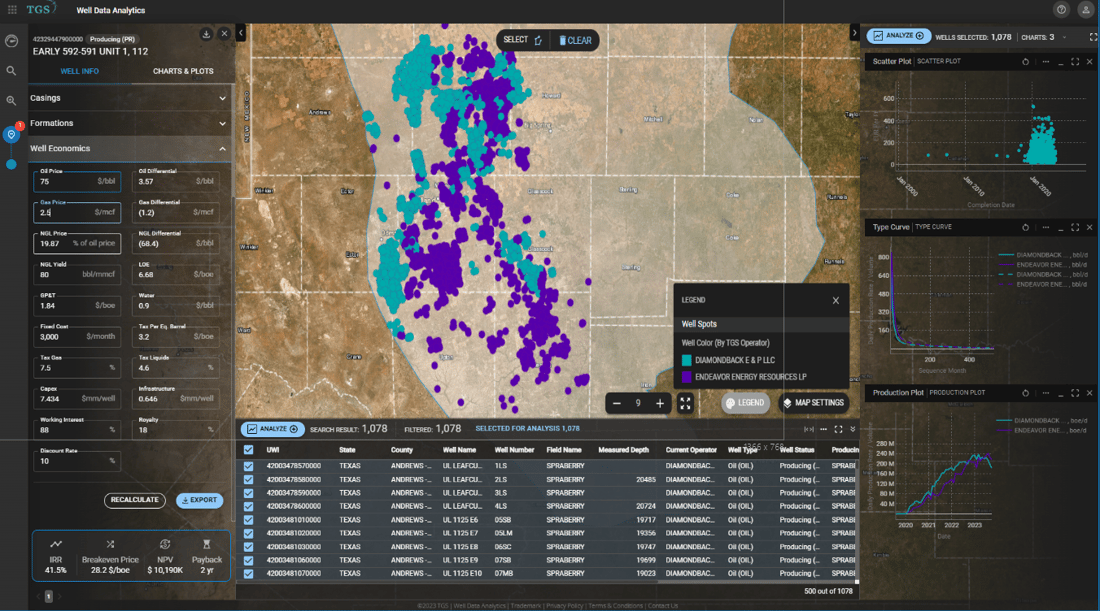

Diamondback Energy, Inc. (NASDAQ: FANG) and Endeavor Energy Resources, L.P. have announced a definitive merger agreement valued at approximately $26 billion, combining to create a leading independent oil and gas company focused in the Permian Basin. The deal includes approximately 117.3 million shares of Diamondback common stock and $8 billion in cash. Diamondback's existing stockholders are expected to own approximately 60.5% of the combined company, with Endeavor's equity holders holding the rest. The merger is seen as strategically advantageous, offering operational synergies, improved capital allocation, and significant financial accretion. Diamondback and Endeavor have complementary acreage in the Midland Basin (Figure 1).

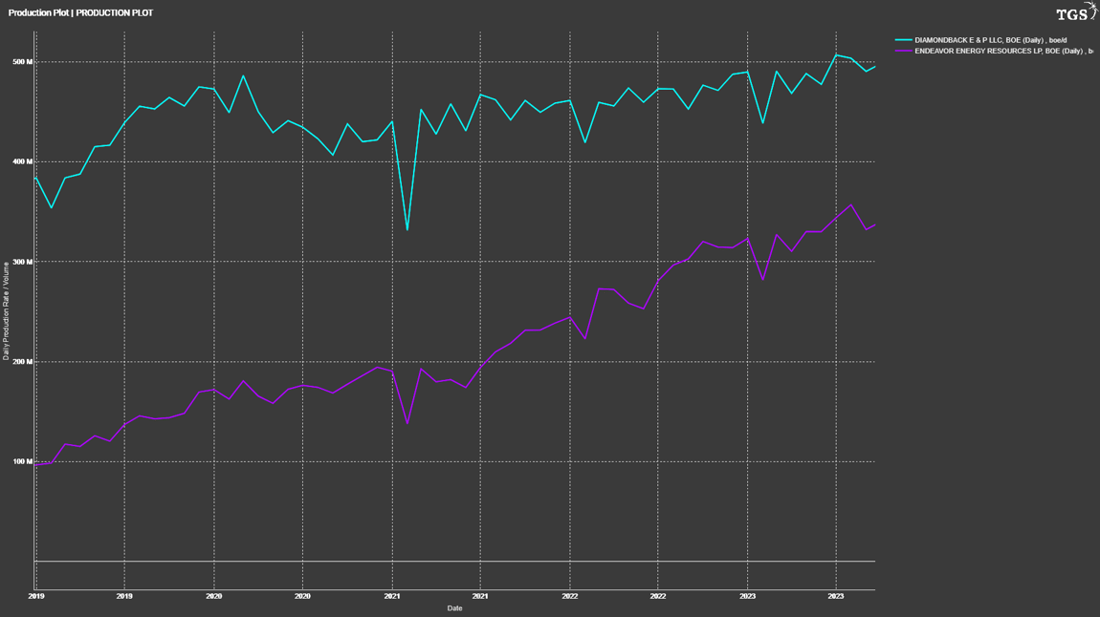

According to TGS’s allocated production, Diamondback produced ~498 Mboe/d and Endeavor produced ~340 Mboe/d as of October 2023 for a pro-forma production of ~838 Mboe/d (Figure 2).

The newly launched Well Economics Dataset within TGS Well Data Analytics allows users to estimate important economic outputs quickly and accurately, including but not limited to Internal Rate of Return (IRR), Net Present Value (NPV), Breakeven Price (BE), and Payback Period that are fundamental to create and run economic models (Figure 1 – left panel). According to the dataset, a type well for Endeavor generates an NPV of ~$8.8 million, breakeven prices ranging from $30.0/boe to $43.3/boe, and payback periods of ~2 to 2.4 years (Figure 1).

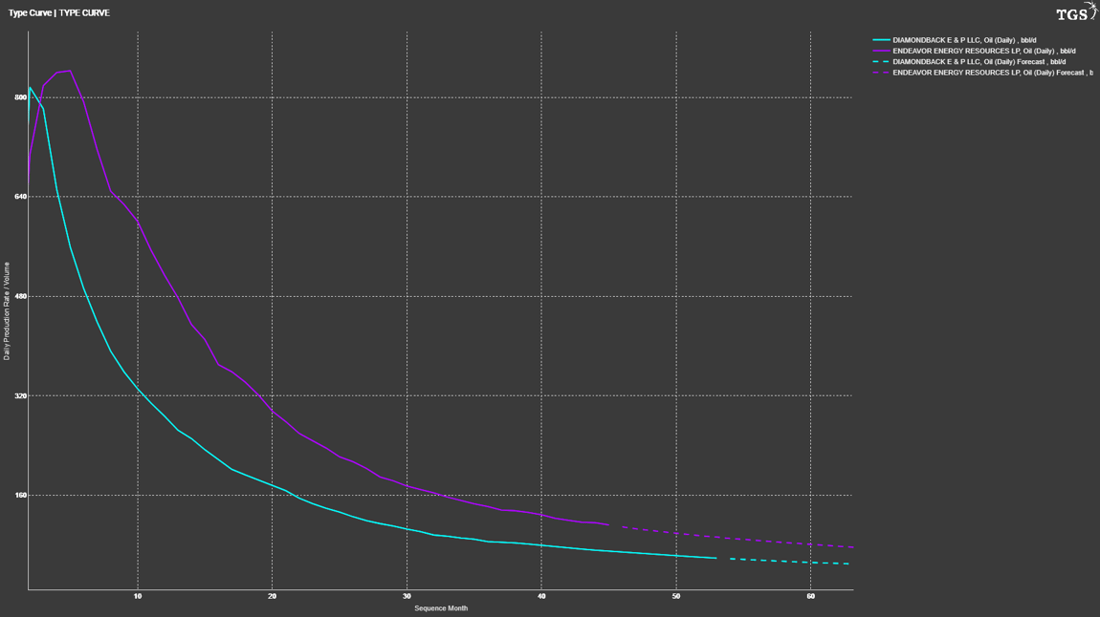

A comparative type curve analysis using Well Data Analytics for producing wells since 2020 indicates that Diamondback has peak production at ~816 bbl/d with an average oil decline rate of 50.2%. In contrast, Endeavor has peak production at ~843 bbl/d with an average oil decline rate of 40.5%. Apart from decline rates, another key difference in their type curve performance is that Diamondback wells peak sooner, between months 2 or 3, whereas Endeavor wells peak around month 4 or 5 of production (Figure 3). In Midland County, where most of the contiguous acreage is located, the average EUR/ft for Endeavor wells is higher than Diamondback wells at ~69 bbl/ft versus ~53 bbl/ft.

The merger is viewed positively by analysts and investors, with Diamondback's stock surging nearly 10% following the announcement. Analysts highlight the industrial logic of the merger and anticipate potential upside through the forecasted $550 million in annual synergies. This deal underscores a consolidation trend in the Permian Basin following recent high-profile acquisitions by major oil and gas industry players.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figure 1. Well Data Analytics dashboard showcasing Well Economics Data on the left panel, Diamondback (blue) and Endeavor (purple) producing wells on the map, and reservoir properties, production trends, and geological insights on the right.

Figure 2. Well Data Analytics production plot in BOE/d for Diamondback (blue) and Endeavor (purple).

Figure 3. Diamondback (blue) and Endeavor (purple) type curves. The plot was derived using TGS Well Data Analytics for producing wells that have a vintage of 2020+.