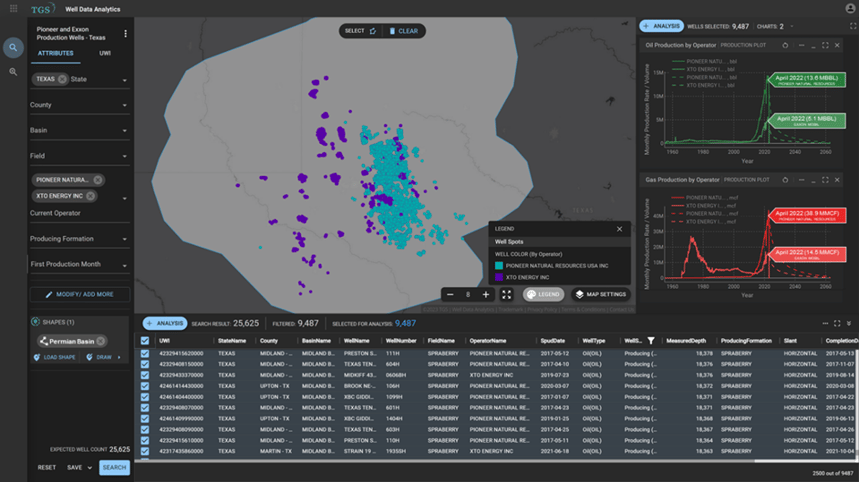

Exxon Mobil and Pioneer Natural Resources assets can be evaluated and benchmarked using TGS Well Data Analytics.

Big news hit the oil and gas industry this week with speculations of a Permian Basin megamerger. The market has been in a frenzy with reports discussing the supermajor Exxon Mobil purchasing Pioneer Natural Resources, a leading Permian Basin shale driller. At this point, these reports are based on rumors and speculations and neither company has expressed their position on the topic. Pioneer Natural Resources is a powerhouse in the Permian Basin, specifically with their Midland Basin assets. In recent years, they have been the leading oil producer in the basin for large-cap companies keeping up with supermajors like Chevron and Exxon Mobil. Pioneer has a unique revenue stream due to their supply chain contracts and mineral right ownership in the basin. With strong supply chain contracts, Pioneer spends less money transporting their produced products to processing plants. Additionally, owning the underlying mineral rights on their assets saves them millions in royalties.

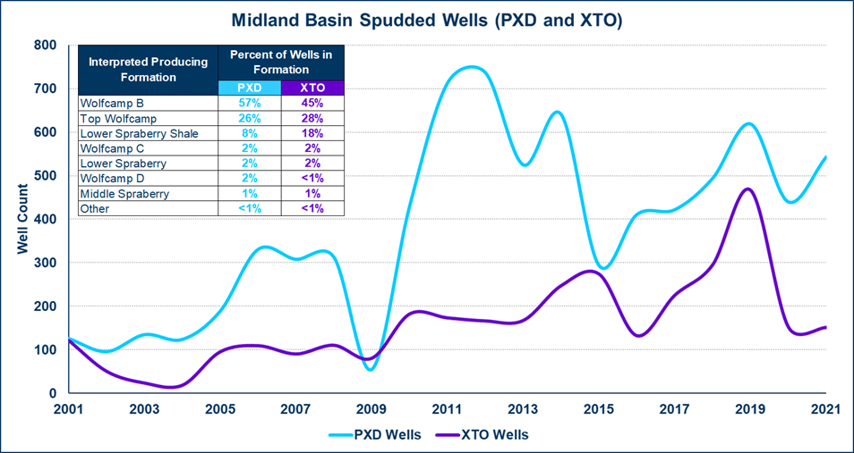

TGS Well Data Analytics provides insightful information regarding the distribution of assets and production that can be used when benchmarking. These companies have very different positions in the Permian Basin with Exxon Mobil (XTO1) operating wells in the Delaware Basin, Central Basin Platform, and Midland Basin whereas Pioneer Natural Resources (PXD1) assets are mostly confined to the Midland Basin. Last year in April 2022, PXD produced 13.6 MBBL of oil and 38.9 MMCF of gas and XTO produced 5.1 MBBL of oil and 14.5 MMCF of gas1. These production numbers are for wells operated by Pioneer Natural Resources USA Inc. and XTO Energy Inc. and does not include non-operated positions. TGS Well Data Analytics also provides informative information regarding spudded wells2 and interpreted producing formations2. Spudded wells from 2001 to 2021 for both companies are variable with PXD increasing spudded wells in recent years compared to XTO. The dataset also indicates the two companies have similar formation targets2. Overall, PXD targets the Wolfcamp B 12% more than XTO and XTO targets the Lower Spraberry Shale 10% more than PXD, respectively. Whether the rumors and speculations are true or false, all eyes will be on these two companies in the coming months.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figures:

1TGS Well Data Analytics application showing an operator map and production plots for Pioneer Natural Resources (PXD) and Exxon Mobil (XTO) producing wells in the Permian Basin. These production numbers are for wells operated by Pioneer Natural Resources USA Inc. and XTO Energy Inc. and does not include non-operated positions.

2TGS Well Data Analytics spudded well data and interpreted producing formations by operator in the Midland Basin.