Higher GOR areas projected to drive gas production growth.

In April’s Short Term Energy Outlook (STEO), the US Energy Information Administration (EIA) reiterated the expectation for US natural gas production to set a record in 2023, rising nearly 3% y-o-y to ~101 bcf/d. A key component of this growth is projected to come from the Permian Basin, specifically from associated gas, with an increase of ~1 bcf/d. Already comprising a third of total US natural gas production, associated gas is expected to drive a 40% increase in natural gas production by 2030.

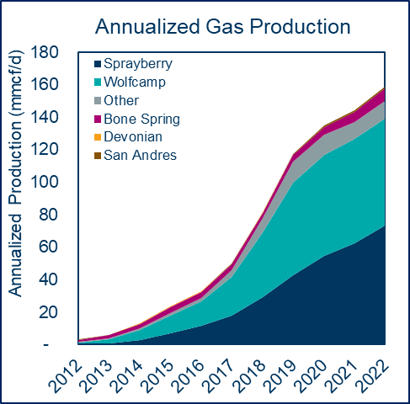

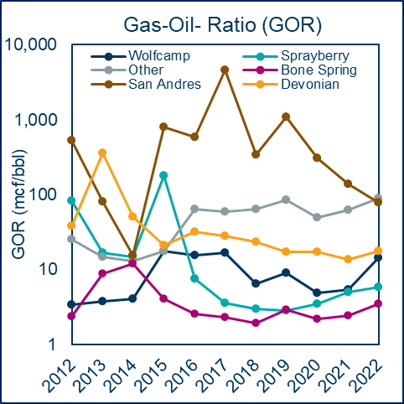

On a formation level, associated gas volumes can vary widely across a particular basin, owing to source rock composition and maturity. In the Permian, operators have prioritized low GOR “sweet spots” in their portfolios, as oil prices have outpaced natural gas coupled with limited takeaway capacity for natural gas. Low GOR areas have been depleted over the last few years, resulting in operators drilling higher GOR portions of the basin, and driving a rise in associated gas production. This rise has resulted in an exponential increase in natural gas production, while GOR as a whole has moderately increased1.

TGS Data shows that the most notable increase in GOR has occurred in the Wolfcamp. Over the last 10 years, it more than tripled, with gas production in the formation increasing by nearly 70 mmcf/d over the same period. In the Spraberry, GOR has doubled since 2017 over the same span, with gas production climbing 55 mmcf/d, becoming the top gas formation in the Permian in 2022. As operators continue to show capital spending restraint to focus on their existing asset portfolios, low GOR “sweet spots” are being rapidly depleted across the Permian Basin, leading to a rise in associated gas and an overall increase in gas production.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

1TGS Well Data Analytics