Riposte Capital LLC, with about 9.9% ownership of SilverBow Resources, has strongly endorsed Kimmeridge Energy Management's proposal to merge SilverBow with Kimmeridge Texas Gas.

Kimmeridge Energy Management has put forth an offer to merge with SilverBow Resources, proposing $34 per share for SilverBow stock and urging South Texas SilverBow shareholders to finalize the deal by April 26. However, uncertainties loom over the completion of the merger. In the ongoing "SilverBow Saga," a notable investor holding approximately 9.9% ownership of SilverBow Resources' outstanding shares has emerged, urging SilverBow to seriously consider Kimmeridge Energy Management's offer. If successful, this merger would establish a nearly 1 billion cubic feet per day (BCF/D) Eagle Ford pureplay.

SilverBow noted that it has engaged extensively with Kimmeridge beginning in August 2022 and back in February 2023, Kimmeridge presented an all-cash acquisition offer for SilverBow, aiming to privatize the company. Nonetheless, the energy-focused investment firm eventually withdrew from the agreement due to its inability to secure the necessary funding.

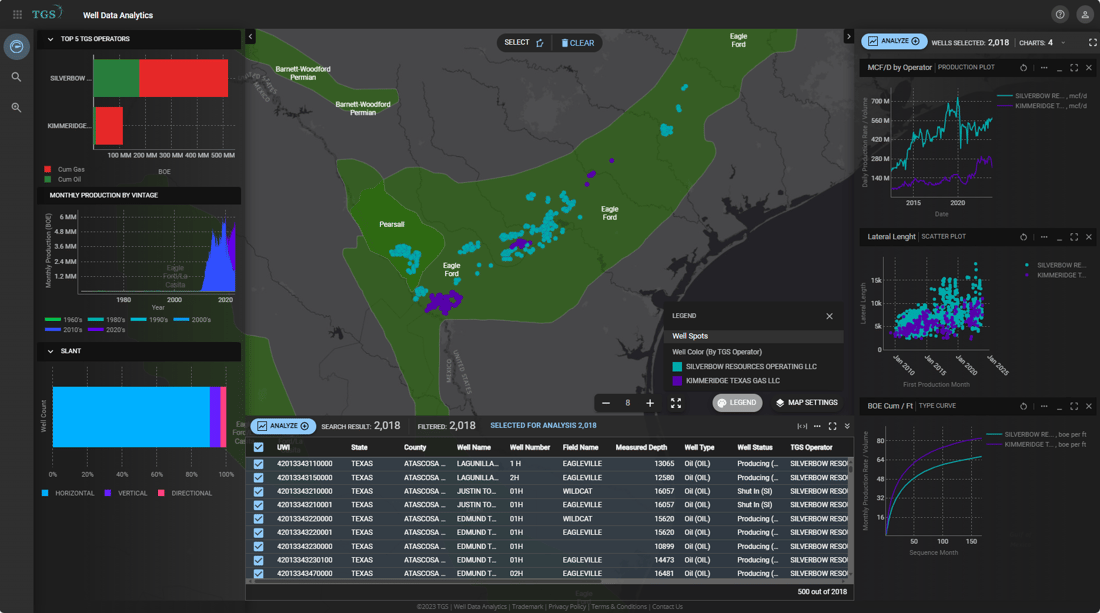

Figure 1 illustrates the geographical coverage of SilverBow and Kimmeridge using the TGS Well Data Analytics application, with SilverBow depicted in teal and Kimmeridge in purple. Kimmeridge's holdings span 148,000 net acres in the Eagle Ford play, with some areas adjacent to SilverBow assets.

Figure 1. TGS Well Data Analytics application showing the geographical coverage of SilverBow and Kimmeridge company assets, including some production analysis charts.

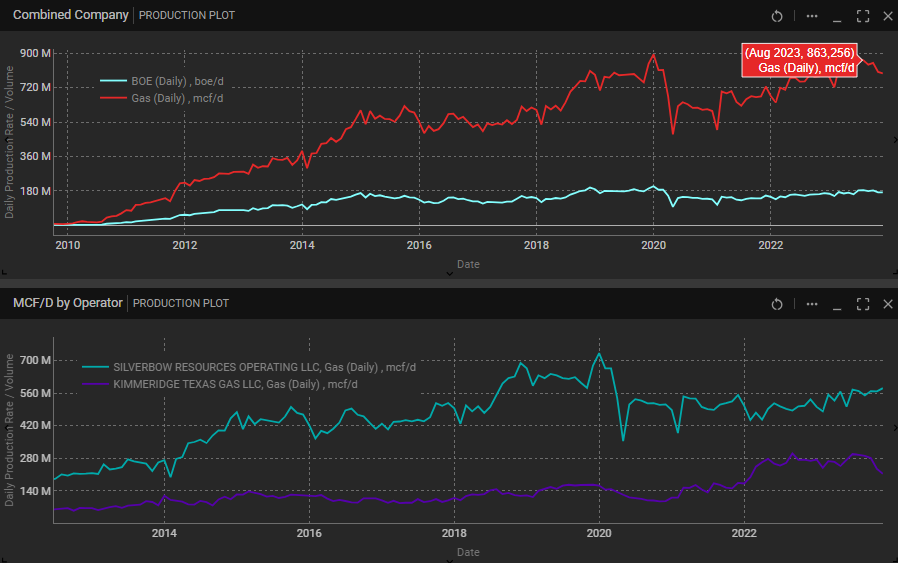

According to TGS Well Data Analytics application, Kimmeridge’s proposed merger of its South Texas E&P Kimmeridge Texas Gas with SilverBow would grow production to ~ 860 MMCF/D (Figure 2) with 1,519 active producing well locations. SilverBow's current production stands at about 570 MMCF/D, while Kimmeridge produces 290 MMCF/D.

Figure 2. TGS Well Data Analytics application image showing the BOE/D and MCF/D for both Kimmeridge and SilverBow since 2010.

Currently, Kimmeridge Energy Management holds 12.9% of SilverBow shares, with other notable shareholders including Riposte Capital (9.7%), BlackRock Inc. (5.9%), State Street (4.15%), and Strategic Value Partners (1.5%), according to Securities and Exchange Commission filings. Kimmeridge's holdings in 2023 included California Resources (in the process of acquiring Aera Energy), Chesapeake Energy and Southwestern Energy (merging), Enerplus Corp. (merging into Chord Energy), and Civitas Resources. Highlighting Civitas Resources' growth, Kimmeridge emphasized its evolution from a $1.2 billion to a $7 billion entity through E&P consolidation in the Rockies and Permian regions, with investors foreseeing benefits from participating in the promising growth of a larger company in the Eagle Ford.

With TGS Well Data Analytics, this type of analysis can be done quickly. For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com