XCL's recent activity shows that top tier Uinta acreage can compete with the top basins in the US.

Speaking at Hart Energy’s DUG conference last month, XCL EVP of Reservoir and Development Mark Graeve made a compelling argument in favor of Utah’s Uinta Basin. “If you average every well XCL operates and compare it to the Permian Basin, we’re competitive today with Lea and Loving counties.”

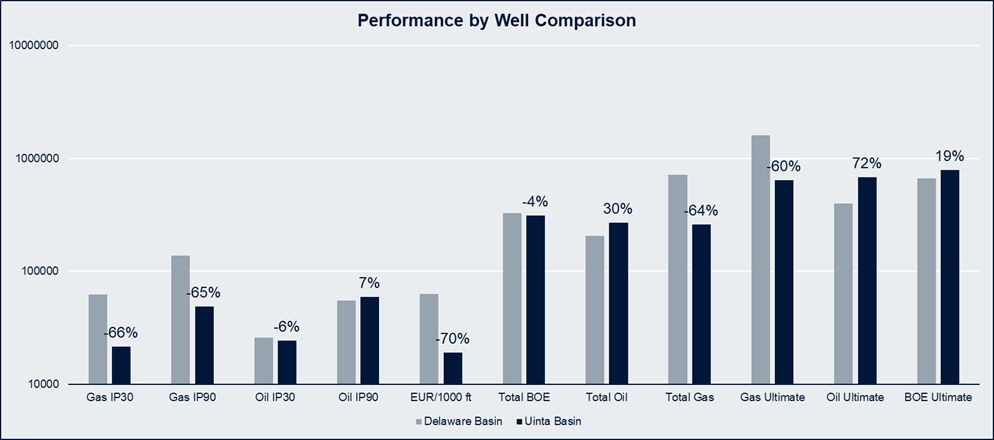

Using TGS Well Data Analytics, we can compare XCL’s performance to the top operators in New Mexico’s Delaware Basin. The type curve below1 shows XCL (lighter shades) exceeding top Delaware operators (darker shades) in oil production, while coming in a bit under Delaware peers in gas production. The bar chart2 shows that XCL typically outcompetes Delaware peers by 72% on Ultimate Oil production and 20% on a Ultimate BOE basis, while underperforming by 60% in gas production and 70% in EUR/1000 ft lateral length on a well-by-well basis. With TGS Well Data Analytics, this type of comparative analysis and benchmarking can be done in minutes.

Mark Graeve also mentioned other factors that affected XCL’s bullishness towards the Uinta, including decreased drilling cost, and differences in produced fluid composition. Overall, XCL’s bet on the Uinta seems to be paying off. The observed well performance will surely attract more attention to the basin so other operators can replicate XCL’s success and transform the Uinta into a true competitor for the Delaware Basin.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

1XCL Uinta and Top 5 Delaware Type Curve Comparison

2XCL Uinta and Top 5 Delaware Average Performance Comparison