Deal provides significant momentum to ongoing CCS projects with up to 110 MT/yr of emissions reductions.

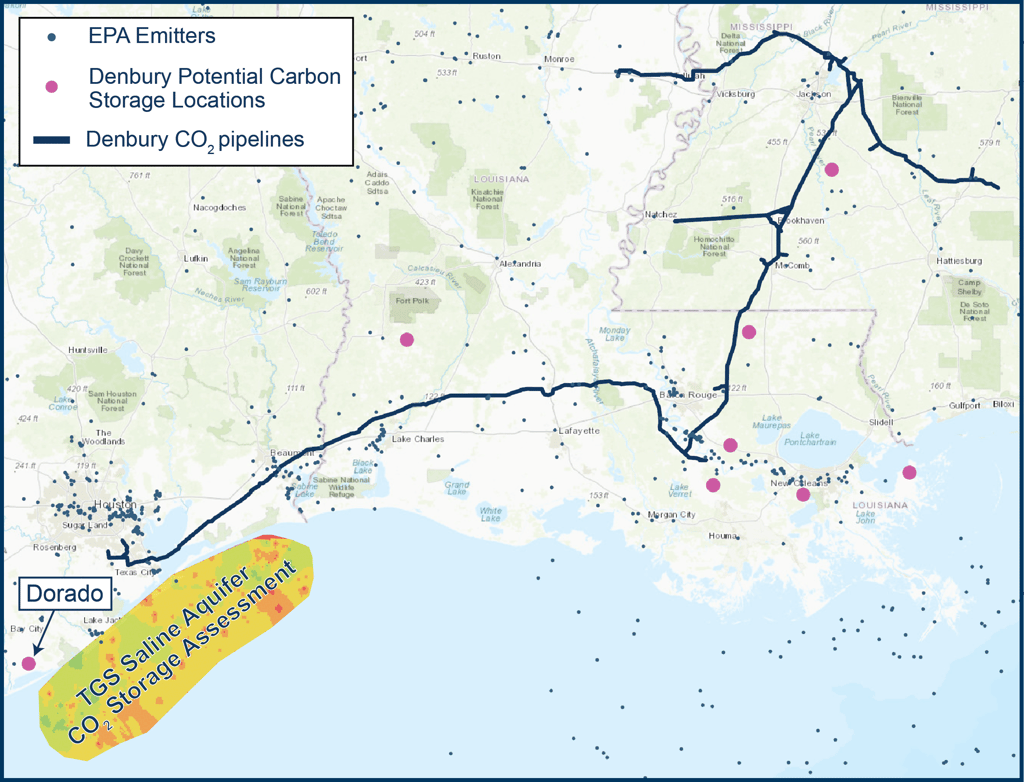

Last Thursday, ExxonMobil announced the acquisition of Denbury Resources in an all-stock transaction valued at $4.9 Billion, marking a significant signal in the carbon capture & storage (CCS) industry. The deal provides ExxonMobil with 1,300 miles of CO2 pipelines and capacity to reduce up to 110 million tons per year (MT/yr) of emissions in the region. It also affords up to 9 permanent onshore carbon storage sites across Alabama, Louisiana, Mississippi, and Texas.

Key synergies in the deal include combining Exxon’s carbon capture technology and subsurface experience with Denbury’s existing CO2 pipeline infrastructure and identified carbon storage sites. One of Denbury’s storage sites, Dorado, is located near a well-suited saline aquifer, as shown in TGS Carbon AXIOM, providing storage capacity and suitability assessment for both saline aquifers and depleted hydrocarbon reservoirs. TGS’ interpretation estimates a total capacity of 40,000 MT in the Miocene alone in the AOI, accommodating Dorado’s planned storage of 115MT and indicating there is significant opportunity for growth.

Annually, Denbury estimates 6-11 MT/yr of CO2 to be injected in the Dorado project. For comparison, the Houston area’s highest annual EPA emitter by volume, as shown in the TGS Carbon AXIOM database, puts out 15 MT/yr of CO2 equivalent. Although still in its early stages, the Denbury acquisition by ExxonMobil could be an inflection point in the growth of the CCS industry.

With TGS Carbon AXIOM, this type of analysis can be done efficiently. The application provides a streamlined assessment of storage capacity derived from the industry’s largest library of geological and well data.

For more information on Carbon AXIOM or to schedule a demo, contact us at WDPSales@tgs.com.