Operators in the Permian Basin continued efforts to push the limits on drilling extended lateral lengths over 15,000 ft in Q2-2023.

Drilling extended lateral wells (>15,000 ft) in the Permian Basin has gained traction among larger producers in the last few years but has also sparked debates. Proponents argue that extended lateral wells offer increased efficiency and cost-effectiveness. Longer wells allow for greater contact with hydrocarbon-rich formations, maximizing resource recovery and boosting production rates. This method reduces the need for additional wells, minimizing surface footprint and environmental impact. Moreover, proponents contend that longer laterals contribute to improved well economics, as the upfront costs associated with drilling and completion are spread over a larger reservoir volume, potentially enhancing the overall return on investment. That may not be true, considering TGS data showing deteriorating productivity per foot. Let’s investigate!

Critics raise concerns about the potential drawbacks of drilling longer lateral wells. One significant argument revolves around the technical challenges of managing and extracting resources from extended wellbores. As lateral lengths increase, operators face greater complexity in wellbore placement, reservoir navigation, and hydraulic fracturing. This may result in operational difficulties, increased costs, and a higher risk of wellbore interference. Additionally, skeptics argue that longer laterals may lead to diminishing returns in terms of incremental production gains on a dollar-per-foot basis, as the incremental increase in contact with reservoir rock may not proportionally translate into higher recoverable reserves.

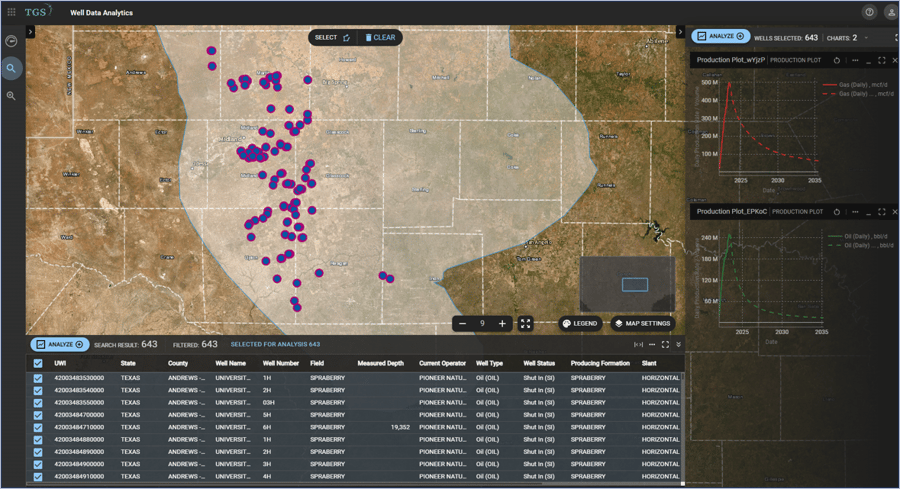

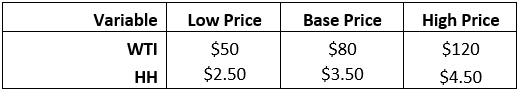

TGS used Well Data Analytics to investigate whether well productivity and well economics are in fact improved by drilling 3-mile lateral rather than 2-mile lateral wells. We analyzed production data for over 400 Midland wells put on production since January 2020. TGS used capital savings per lateral foot drilled of 15% for 3-mile laterals, in line with recently reported capital savings by operators in the area. TGS’ Well Economic Model was run at various flat price scenarios, as shown in Table 1, to obtain well economic results.

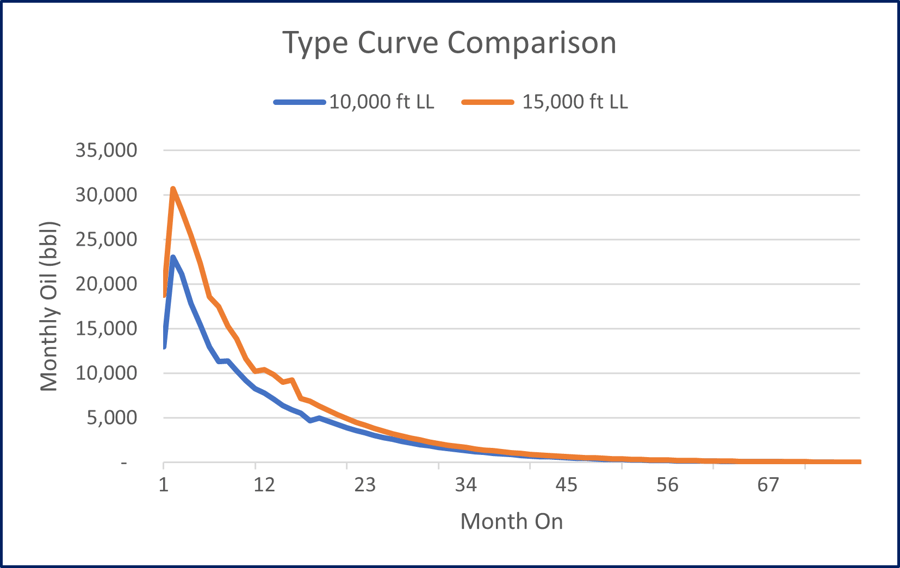

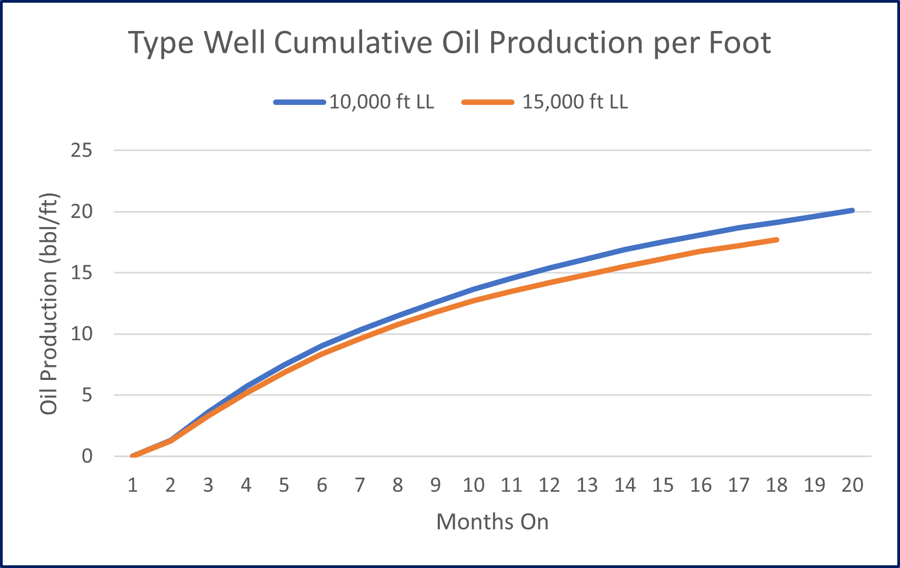

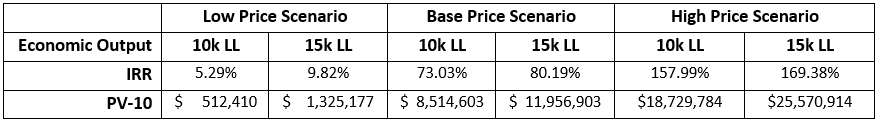

Regarding productivity, although type curve oil production volumes increase for a 3-mile lateral compared to a 2-mile lateral well (Figure 2), the cumulative oil production per foot deteriorates for extended lateral wells (Figure 3). In contrast, well economics benefit from producing additional barrels sooner, translating into extra free cash flow, especially at current oil prices of around $80/bbl (our base case scenario). As observed in Table 2, the internal rate of return increases by approximately 720 basis points, and the net present value improves by ~$3.5 million for a 3-mile lateral well compared to a 2-mile lateral well for the base case price scenario at $80/bbl and $3.5/mcf. Similar results are observed for the low and high-price scenarios, keeping a similar cost structure for both types of wells, as presented in Table 2.

As technology and industry practices evolve, finding the optimal lateral length that maximizes resource recovery while addressing operational challenges will be crucial for the sustainable development of oil and gas resources in the basin.

For more information on Well Data Analytics contact us at WDPSales@tgs.com or visit our website Well Data Analytics.

Figure 1. Area of Interest Close-up Wells in Well Data Analytics. Oil and Gas Production Plots Displaying Actual and Forecasted Production Volumes.

Figure 2. Type Curve Comparison for 2-mile lateral wells (10,000 ft) vs. 3-mile lateral wells (15,000 ft).

Figure 3. Cumulative Oil Production per Foot for 2-mile lateral wells (10,000 ft) vs. 3-mile lateral wells (15,000 ft).

Table 1. Commodity Price Scenarios Used for Well Economic Analysis.

Table 2. Economic Output Table Showing a Comparison of Internal Rate of Return (IRR) and Net Present Value (NPV) for a 2-mile lateral well (10,000 ft) vs. a 3-mile lateral well (15,000 ft) for a Type Well using Various Price Scenarios.