The merger creates a top U.S. shale producer with balanced assets across the Permian and DJ basins and data insights reveal where performance stands out

SM Energy and Civitas Resources have announced plans to merge in an all-stock transaction valued at approximately $12.8 billion, including debt. The deal will create one of the top 10 independent oil producers in the United States, establishing a strong position across both the Permian Basin and DJ Basin. The combined company will operate under the SM Energy name and will be headquartered in Denver, Colorado.

As investors continue to emphasize capital discipline and shareholder returns over aggressive growth, U.S. shale producers are increasingly turning to strategic consolidation to enhance scale, efficiency, and long-term competitiveness.

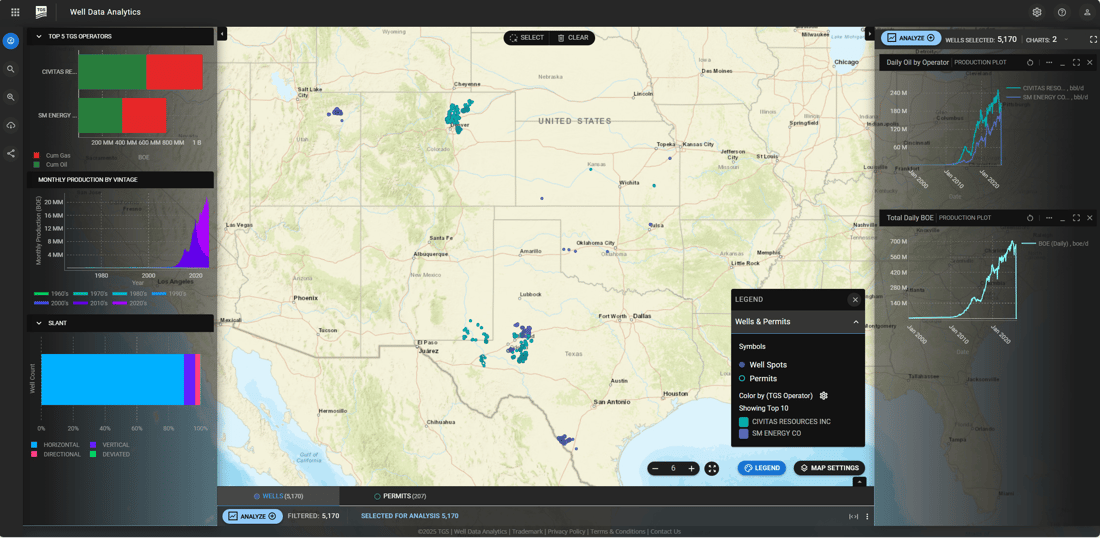

SM Energy: Founded in 1908 as St. Mary Land & Exploration, SM Energy has evolved into a well-established independent exploration and production company. Headquartered in Denver, SM has built a diversified portfolio spanning the Eagle Ford, Midland Basin, and Uinta Basin, achieving steady growth through strategic acquisitions and consistent reserve expansion. SM’s current production averages 214 Mboe/d, including 114 Mbbl/d of oil, driven by strong performance across all core assets. Compared with the third quarter of 2024, total net daily production increased 26%, while oil output rose 47%, reflecting operational efficiency and portfolio optimization (Figure 1).

Civitas Resources: Though officially established in 2021, Civitas Resources traces its roots to legacy DJ Basin operators such as Bonanza Creek Energy, Extraction Oil & Gas, and Crestone Peak Resources. Through a series of transformative mergers, Civitas quickly emerged as one of the most dynamic and sustainability-focused operators in U.S. shale. Originally a pure DJ Basin operator, Civitas entered the Permian Basin in 2023 through the acquisitions of Hibernia Energy III and Tap Rock Resources, followed by the purchase of Vencer Energy’s Midland Basin assets from Vitol for $2.1 billion. These deals expanded its footprint to roughly 440,000 net acres across top-tier shale plays. Civitas’ recent production averaged 312 Mboe/d, including 141 Mbbl/d of oil from its operations in the Permian and DJ basins. Although output declined 14% and 12% respectively from late 2024, largely due to expected DJ Basin declines, production is forecast to rise about 5% as additional wells come online (Figure 1).

Figure 1. TGS Well Data Analytics dashboard displaying the operator map, 2025 approved permits and production plots for Civitas and SM Energy assets.

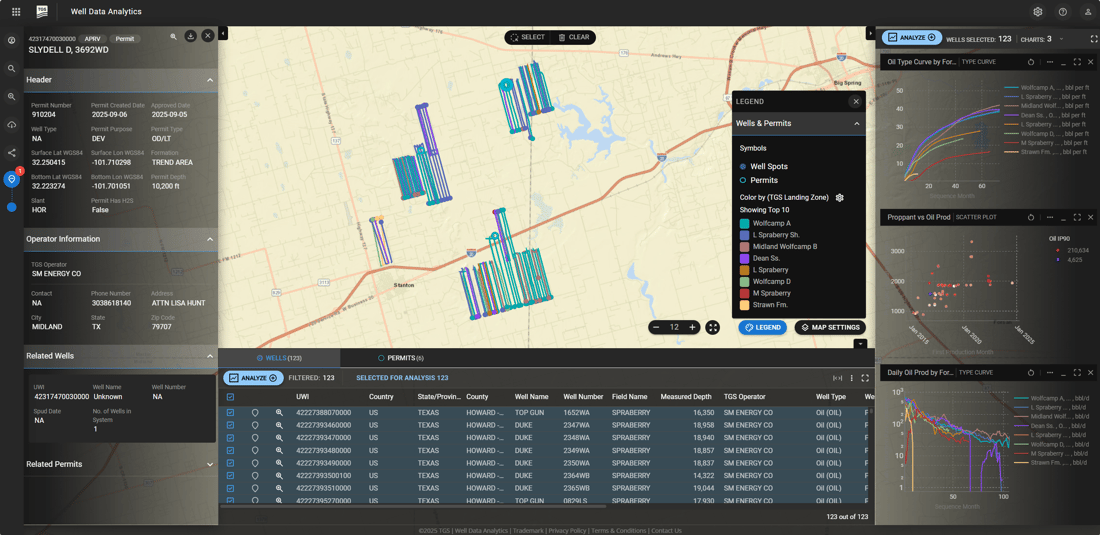

Using TGS Well Data Analytics (Figure 2), we evaluated a section of the Midland Basin with recent leasing and permitting activity by both operators to compare productivity and formation performance. Lateral-length–normalized oil production type curves, grouped by TGS Landing Zones, show that the Wolfcamp A & B, Lower Spraberry Shale, and Dean Ss formations exhibit the highest productivity among key intervals. Further analysis revealed a positive correlation between oil production and injected proppant volume per lateral foot, highlighting the operational strategies driving superior well performance. With TGS Well Data Analytics, such benchmarking and comparative studies can be conducted in minutes, supporting faster, data-driven development decisions.

Insights like these underscore the strategic logic behind the SM–Civitas merger. Both companies bring complementary geological footprints and proven operating models—SM with its deep experience and infrastructure in Texas and Utah, and Civitas with its efficiency and sustainability focus in the DJ and Permian basins. So, it should be no surprise that they predict $200 million in annual cost savings from synergies.

Figure 2. TGS Well Data Analytics application showing the Civitas and SM Energy Howard and Martin counties, Midland Basin wells including type curve comparisons by formation and completions evaluation.

The merged company will control approximately 823,000 net acres across premier U.S. shale basins and is expected to generate over $1.4 billion in free cash flow this year. On a pro forma basis, second-quarter 2025 production is projected to reach 526 Mboe/d, with nearly half coming from the Permian Basin (Figure 1). By uniting two of the most efficient operators in U.S. shale, the merger combines SM Energy’s deep Texas and Utah operations with Civitas’ high-return Permian and DJ Basin assets, forming a balanced and resilient portfolio built for long-term value creation.

Herb Vogel, CEO of SM Energy, will lead the new entity. The 11-member board will include six directors from SM Energy and five from Civitas. The transaction is expected to close in the first quarter of 2026.

For more information about TGS Well Data Analytics or to schedule a demo, please contact us at WDPSales@tgs.com.