The Company aims to become a leading supplier of lithium for electric vehicles (EV) by 2030.

The global demand for lithium, a crucial component in rechargeable batteries powering everything from smartphones to electric vehicles, has spurred significant interest in the lithium industry. As technology advances and the world transitions towards cleaner energy solutions, lithium has become a focal point for many major players in the energy sector. Recently, ExxonMobil made headlines with its press release announcing the commencement of drilling for lithium in Arkansas, USA.

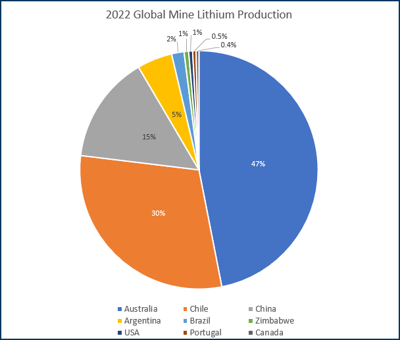

Arkansas, chosen as the location for ExxonMobil's first lithium drilling project, holds promise as a significant source of lithium reserves. The geological conditions in the region are favorable for lithium deposits, making it an attractive prospect for extraction. This move is economically significant for the state and aligns with broader efforts to establish a domestic supply of critical minerals, reducing dependence on foreign sources. According to USGS estimates, the USA produced less than 1% of global mine lithium production volumes in 2022 (Exhibit 1).

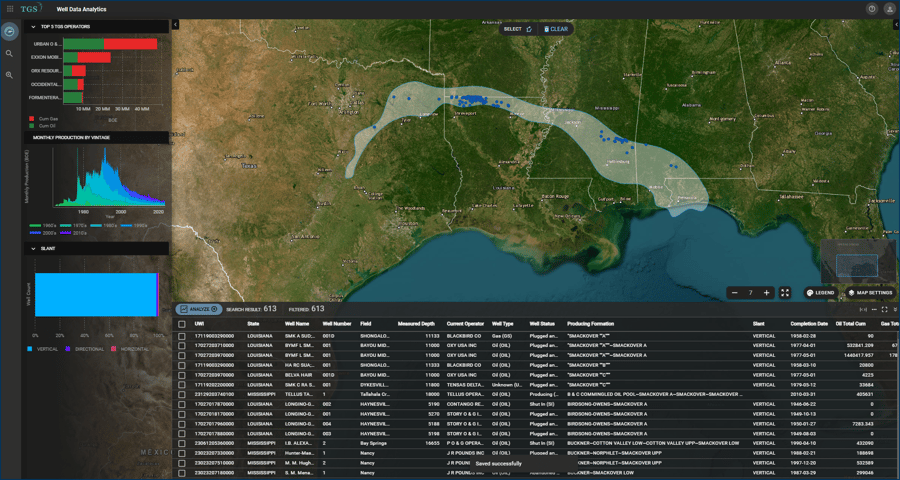

The Smackover Formation is an extensive, porous, and permeable limestone aquifer extending from Central Texas to the Florida Panhandle. According to TGS’ Well Data Analytics, 613 wells have historically produced from the Smackover Formation. Circa 87% are in Louisiana, followed by Mississippi (~11%) and Texas (~2%). Almost all wells are vertical in trajectory, with only nine directional and two horizontal wells. Most of these wells were drilled in the 1980s (~40%) and 1990s (~36%). Only 34% of these wells are still active, with the rest either shut in or plugged and abandoned (Figure 1).

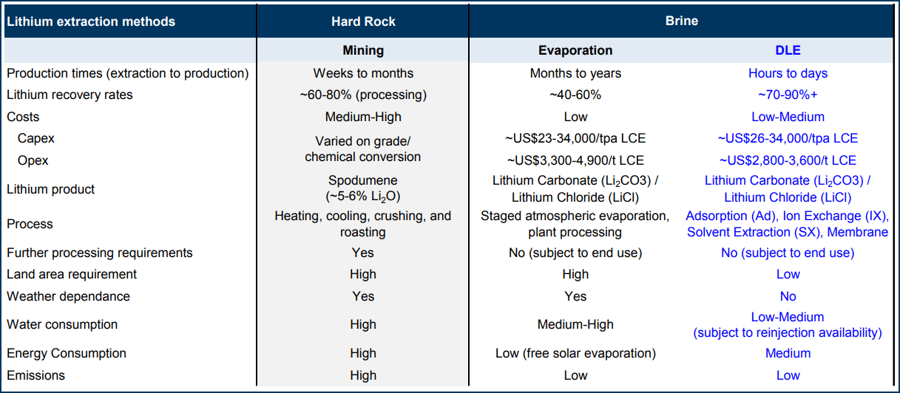

Direct Lithium Extraction (DLE), a new technology yet to be deployed at commercial scale, is one of the preferred methods to extract the valued mineral. As highlighted in Exhibit 2, DLE has the highest potential for lithium recovery rates while at the same time offering environmental benefits such as lower land usage requirements, low water consumption, and low carbon emissions when compared to mining and evaporation processes.

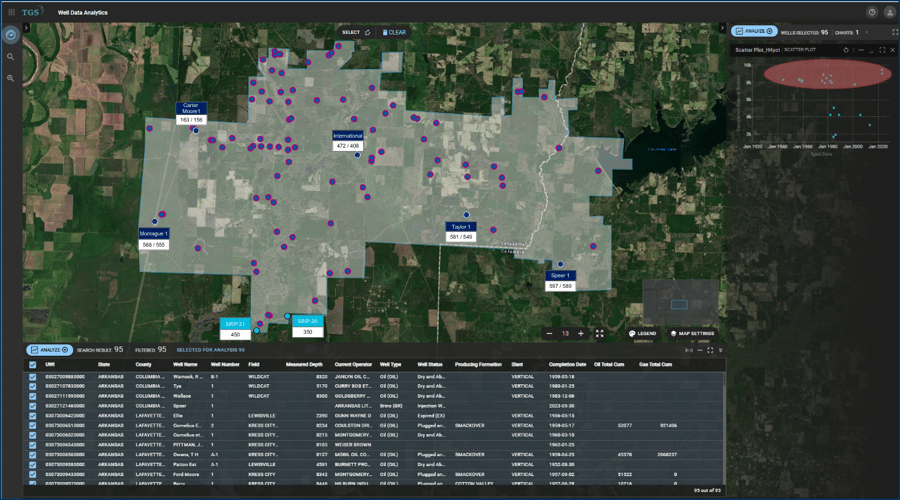

A lithium concentration anomaly is shown at a brine lease in SW Arkansas (Figure 2), the region ExxonMobil chose for the lithium project. The reason for the anomaly is the lithium-concentrated brine reservoirs in the upper and middle Smackover Formation between 7,500 ft and 8,800 ft. Maximum brine lithium values recorded in the area vary from 350 to 597 mg/L. Eighteen out of the ninety-five wells under the brine lease have completion intervals ranging from 7,600 ft to 8,800 ft, making them feasible candidates for brine production for lithium extraction purposes, according to Well Data Analytics.

The decision to drill for lithium in Arkansas signifies a strategic move towards diversification and aligning with the growing demand for clean energy solutions. This venture not only positions ExxonMobil as a player in the lithium market but also underscores the industry-wide recognition of lithium's critical role in the future of energy.

For more information on Well Data Analytics contact us at WDPSales@tgs.com or visit our website Well Data Analytics.

Exhibit 1. 2022 Global mine lithium production according to USGS.

Exhibit 2. Comparison of lithium extraction methods.

Source: Goldman Sachs Global Investment Research

Figure 1. Smackover Formation shapefile in Well Data Analytics. O&G wells filtered to contain wells producing from the Smackover Formation.

Figure 2. Smackover Formation Brine Lease close-up. Light blue wells represent average brine values taken in 2018. Dark blue wells contain highest and average lithium concentration values obtained in 2023. Wells highlighted in red in the scatter plot represent wells with completion bottom intervals ranging between 7,600 and 8,800 ft.