The Bureau of Land Management is seeking public input on potential lease parcels in New Mexico and Kansas

The Bureau of Land Management (BLM) in New Mexico has initiated a 30-day public commentary phase concerning the possible incorporation of 26 oil and gas parcels, spanning 6,162 acres, into an imminent lease sale encompassing New Mexico and Kansas. This open feedback period, concluding on December 20, 2023, beckons for public input regarding these parcels, potential deferrals, and associated environmental assessments. Detailed information regarding the parcels and procedures for submitting comments can be accessed through the BLM's ePlanning website.

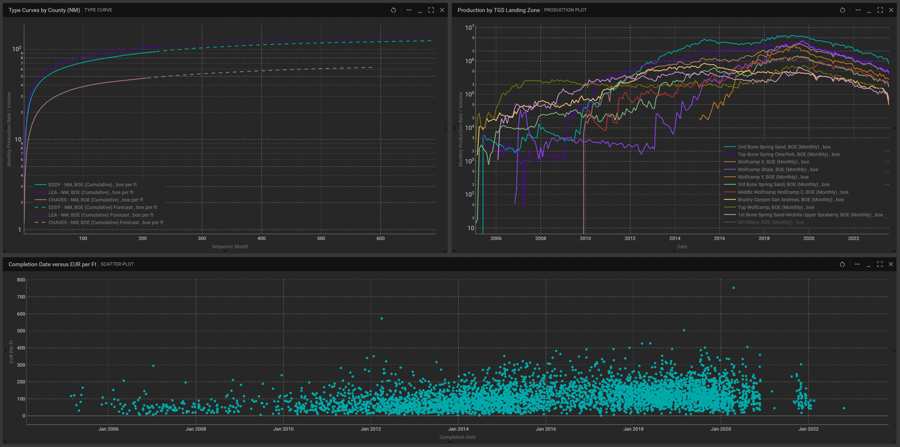

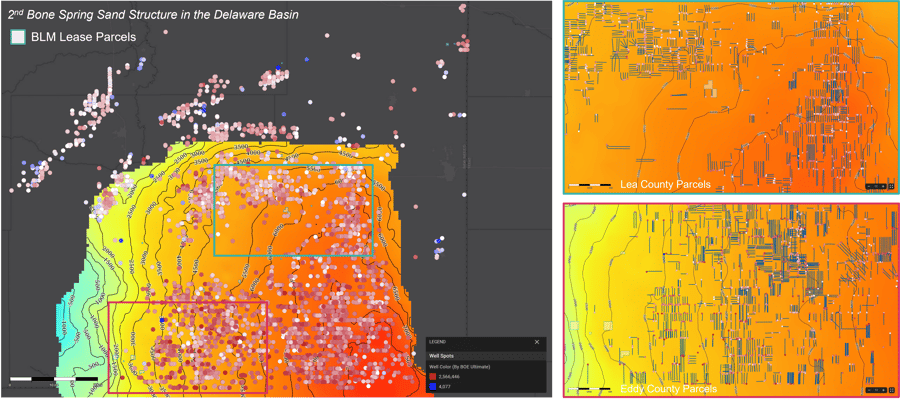

Utilizing TGS Well Data Analytics expedites the assessment of these parcels for hydrocarbon production. Focusing on the northern Delaware Basin assets within New Mexico earmarked for potential lease inclusion, these assets occupy prime regions renowned for their capacity to produce hydrocarbons. In the northern Delaware Basin of New Mexico, the average Estimated Ultimate Recovery (EUR) is 916 thousand barrels of oil equivalent (MBOE) with Eddy County emerging as the foremost county in hydrocarbon production, closely followed by Lea County. Notably, the 2nd Bone Spring Sand and Wolfcamp X formations stand out as the predominant sources of production. Recent assessments reveal an upward trend in EUR per foot of lateral length in newly completed wells, indicative of improving horizontal completion and production strategies. Lateral lengths for the northern Delaware Basin (NM) are 2,000 to 10,000 feet with some recent wells reaching 20,000 feet.

Scrutinizing individual parcels, wells adjacent to the southern Eddy County parcels demonstrate projected production statistics averaging 875 MBOE when extracting resources from the 2nd Bone Spring Sand and Wolfcamp C formations. Occidental Petroleum, ConocoPhillips, and Mewbourne Oil stand as prominent operators in the vicinity of the southern Eddy County parcels, boasting commendable production rates. Meanwhile, Lea County parcels exhibit slightly lower BOE Ultimate estimations averaging 555 MBOE when exploiting resources from the Wolfcamp X and 2nd Bone Spring Sand formations. ConocoPhillips, Mewbourne Oil, and Coterra Energy represent nearby operators demonstrating high production rates.

In summary, the potential inclusion of the oil and gas parcels from New Mexico in the upcoming lease sale holds significant value, particularly within Eddy and Lea Counties, contingent upon employing the appropriate completion and production strategies.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figures:

Type curves by county, production by TGS Landing Zone, and a cross plot of completion date versus estimated ultimate recovery per foot. Plots generated in TGS Well Data Analytics.

Map visualizations showing 2nd Bone Spring Sand structure and BOE Ultimate in the northern Delaware Basin. Figure generated using TGS Well Data Analytics.