TGS is proud to unveil Well Economics Data as part of TGS Well Data Analytics, translating geology, completions data, and well productivity into Net Present Values and wellhead breakeven prices.

The oil and gas industry has experienced a seismic shift since October 2023, marked by significant mergers and acquisitions, including the groundbreaking ExxonMobil Pioneer deal, strategic maneuvers by Chevron Hess, and the dynamic synergy of OXY CrownRock. These transformative changes underscore the industry's adaptability to market conditions and will significantly impact U.S. hydrocarbon production, particularly from unconventional sources. In response to this evolving landscape, a recent TGS Well Intel article examines the role of Well Economics Data within TGS Well Data Analytics, highlighting its potential to streamline asset valuation and investment decision-making in the context of these mega-mergers.

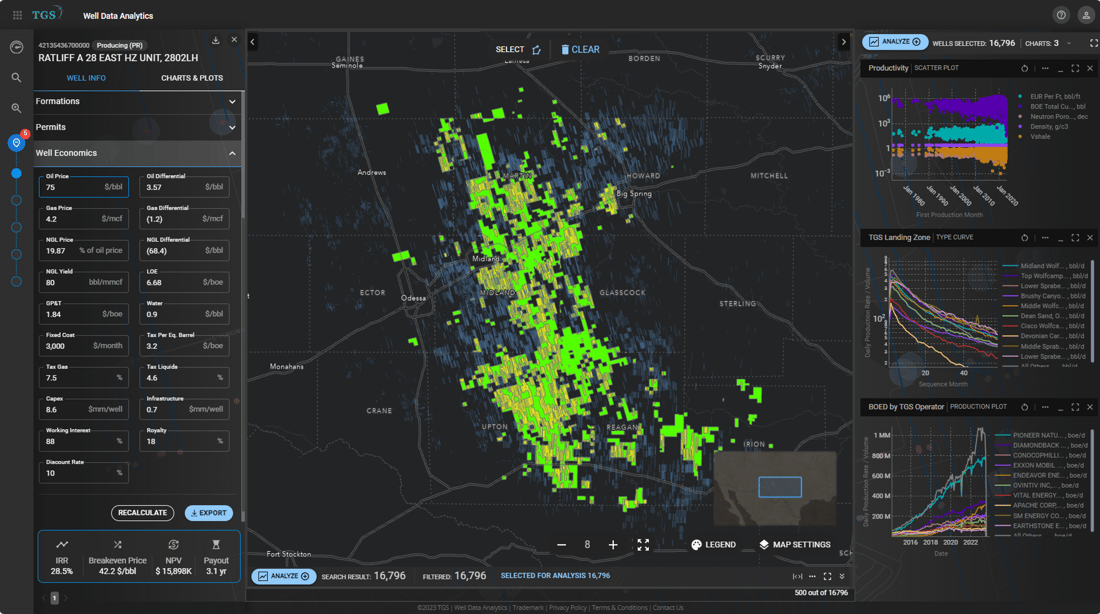

The asset valuation process in the oil and gas industry is complex due to geological variations, reservoir characteristics, and volatile commodity prices. TGS addresses these challenges through its Well Data Analytics solution, providing comprehensive information on reservoir properties, production trends, geological insights, and economic data (Figure 1). The article details a case study on the ExxonMobil Pioneer deal using the recently launched TGS Well Economics Data within Well Data Analytics. The analysis estimates the transaction value to be between $53 to $61 billion by leveraging TGS data and asset valuation workflows. The study showcases how TGS empowers industry professionals with tools to navigate asset valuation intricacies, facilitating informed investment decisions.

The case study specifically focuses on Pioneer's operations in the Midland Basin, analyzing drilling strategies, lateral lengths, production data, type curves, and economic assumptions. TGS Well Data Analytics assists in assessing the number of undeveloped locations, well spacing, and developed and undeveloped acreage economic valuation. TGS Well Economics Data is utilized to establish a type well, run an economic model, and estimate important economic outputs, such as Internal Rate of Return (IRR), Net Present Value (NPV), Breakeven Price (BE), and Payback Period.

At the core of the TGS Well Economics Data is its ability to deliver comprehensive well economic statistics, offering users insights into the performance of various assets based on highly accurate well data and well-specific cost models. Integrating this data with analytics workflows in Well Data Analytics enables users to simulate and forecast economic scenarios precisely. Its user-friendly interface with customizable inputs sets TGS Well Economics Data apart, allowing users to tailor analyses to their specific needs, supporting geoscientists and financial professionals alike.

The last eighteen months have been transformative in the oil and gas industry in terms of consolidation, particularly for the US onshore market. The article summarizes the three largest acquisitions from this period and performs an in-depth case study on the ExxonMobil / Pioneer deal. Using the recently released TGS Well Economics Data, in addition to well and production data, well spacing data, type curves, and visualizations from TGS Well Data Analytics, we predict an estimated value of $28 to $32 bn for the producing resource and $25 to $29 bn for the undeveloped resource, confirming the deal value of this acquisition purely on a cash flow analysis basis. This case study shows how TGS Well Data Analytics with Well Economics Data can streamline complex asset and company valuation processes across a wide range of scenarios.

As TGS continues their commitment to delivering excellence, TGS Well Economics Data stands as a testament to their dedication to providing customer-driven, customizable, and in-depth data solutions to empower businesses in navigating the complexities of today's economic landscape.

You can read the full article here to learn more about the methodology and results.

For more information on Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figure 1. Well Data Analytics dashboard showcasing Well Economics Data on the left, Pioneer’s developed and undeveloped acreage on the map, and reservoir properties, production trends, and geological insights on the right.