TGS Well Data Analytics solution unpacks how the new rules impact the bottom line for O&G producers.

The Biden administration announced last Friday significant reforms to revise the Bureau of Land Management’s (BLM) oil and gas leasing regulations, which will ensure “a balanced approach to development, provide a fair return to taxpayers and help keep drilling activities from conflicting with the protection of important wildlife habitat or cultural sites.” These reforms are poised to increase fees for oil and gas companies operating on federal lands. TGS analysis of wells on federal lands shows a reduction in NPV of up to 20% due to the higher royalty rate, corresponding reductions in IRR, and a slightly longer payback period.

Main elements of the new rule include:

- Bonding Requirements: The rule increases the minimum lease bond amount to $150,000 and the minimum statewide bond to $500,000, eliminating nationwide and unit bonds. The previous lease bond amount of $10,000 was set to meet reclamation obligations. Bond amounts will be adjusted for inflation every ten years.

- Fiscal Terms: Several fiscal terms are changed to reflect provisions of the Inflation Reduction Act (IRA), including:

- Royalty rates for leases are set at 16.67 percent until August 16, 2032—ten years after enactment of the Inflation Reduction Act—then 16.67 percent will become the minimum royalty rate. Previously, the minimum royalty rate was 12.5 percent.

- Minimum bids: The minimum amount companies can bid at auctions for federal oil and gas leases increases to $10 per acre, up from $2 per acre. After August 16, 2032, that amount will be regularly adjusted for inflation.

- Base, or minimum, rental rate: Leases will include a rental of $3 per acre per year during the first two-year period beginning upon lease issuance, then $5 per acre per year for the subsequent 6 years, and then $15 per acre per year thereafter. After August 16, 2032, those rental rates will become minimums and are subject to increase. Previously, companies paid $1.50/acre for each of the first five years of holding a lease, then $2/acre for the next five years.

- Royalty rates for leases are set at 16.67 percent until August 16, 2032—ten years after enactment of the Inflation Reduction Act—then 16.67 percent will become the minimum royalty rate. Previously, the minimum royalty rate was 12.5 percent.

Under the new policy, O&G companies will face higher bonding rates to cover the costs of plugging abandoned wells, increased lease rents, minimum auction bids, and increased royalty rates for extracted fuels. Additionally, the rules will restrict drilling activities in environmentally and culturally sensitive areas. A recent TGS article on orphaned wells explores the magnitude of abandoned wells in the US and estimates it at approximately 1.5 million wells. The article also investigates challenges in plugging them and potential solutions, including technological innovations and renewable energy conversion, as well as funding options highlighting industry, regulatory, and bipartisan support for addressing the issue.

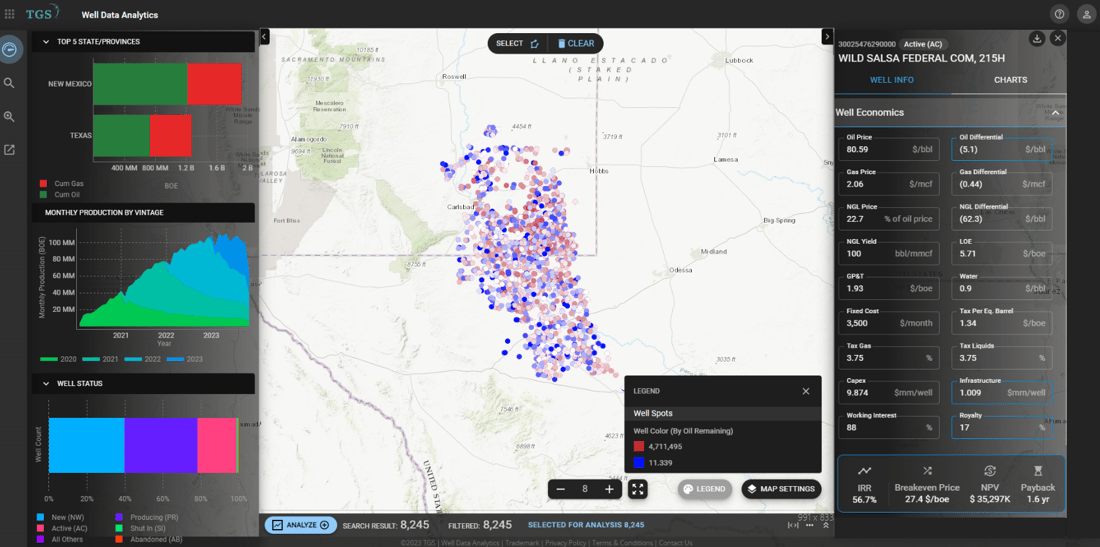

The two main elements impacting well economics under the new BLM rules were modeled using our recently launched Well Economics product within TGS Well Data Analytics (Image 1). A recent vintage well in New Mexico from the Delaware Basin was used to model the increased royalty fees and the higher bond requirements:

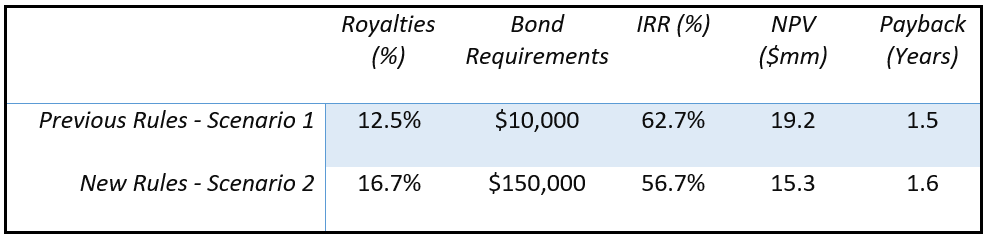

Table 1. Economic input and output results contrasting the old and new bond requirements and royalty fees for Federal Land Leasing Projects using a recent well (2022) from the Delaware Basin in New Mexico.

As inferred from Table 1, under Scenario 2, which includes the new rules for Federal Land O&G projects, the Internal Rate of Return (IRR) is reduced by 600 bps, NPV is approximately 20% lower, and payback time increased by a couple of months when compared to the previous set of rules (Scenario 1). Even though the change may seem marginal initially, it can prove decisive for the future development of remaining inventory or undeveloped locations. As stated by Holly Hopkins, American Petroleum Institute Vice President of Upstream Policy, "Overly burdensome land management regulations will put this critical energy (O&G) supply at risk".

Image 1. Well Data Analytics dashboard displaying producing states, monthly production, and well status on the left, well spots colored by remaining oil in the map, and well economic inputs and outputs for a well in the Delaware Basin under Scenario 2.

TGS Well Data Analytics can quickly and accurately perform this type of analysis. For more information on TGS Onshore Products, contact us at WDPSales@tgs.com.