Norwich, UK (30 September 2025) – Global awards of new offshore wind sites and offtake contracts fell more than 70% in the first nine months of 2025, according to a new industry report. In its latest Quarterly Market Overview report, TGS | 4C, a global market and supply chain intelligence provider, said recent setbacks are prompting a reset as governments, developers and suppliers adapt to new market conditions.

Instead of pursuing larger gigawatt targets, the analysis indicates that policy stability, reliable offtake agreements and flexible policies are taking precedence. As auctions slow and supply chains tighten, governments are implementing new frameworks while developers focus on flexibility and risk sharing to protect projects during volatile cycles, creating a more stable and attractive market for investment.

Key findings in this edition of the Quarterly Market Overview report include:

- Auctions are stalling, but there is room for recalibration: Of about 20 GW of global offtake auctions expected in 2025, 2.2 GW has been awarded so far. This compares with an annual offtake award average of 11.7 GW in 2022, 2023 and 2024. Several major European auctions have been postponed, with top developers sitting out entirely.

- Fewer new site awards. This year has also seen a significant decrease in the rate of new site awards, as governments have delayed lease rounds and developers’ appetite for new sites has waned. A total of 11.2 GW has been awarded to date, compared with an annual average of 70 GW in 2022, 2023 and 2024. Fewer site awards translate into a sharp fall in demand for site surveys.

- Policy responses emerging: Germany, the Netherlands and Denmark are among the countries preparing new Contract for Difference (CfD) and site awards frameworks to improve project bankability and restore investor confidence. Site award and offtake auction delays can sometimes be prudent, avoiding failed rounds due to weak competition.

- Permitting is keeping up. During the first three quarters of 2025, 14.6 GW achieved final consent, which is just slightly lower than last year’s permitting record.

- Floating wind is fragile: Current momentum hinges on just a handful of projects in France, South Korea, and the UK. France is the most resilient market, backed by €11 billion in European Commission funding for three floating projects.

- Turbine bottleneck: TGS | 4C’s supply and demand modelling indicates a potential turbine shortfall of about 2,500 units (about 40 GW) by 2040, underscoring the importance of global manufacturing expansion and Chinese supplier integration.

- Decommissioning creates new pathways: TGS | 4C has introduced decommissioning forecasts for the first time. By 2040, about 3 GW of projects will reach end-of-life, rising to 27 GW by 2050. Decisions around repowering, lifetime extension or removal present new investment opportunities.

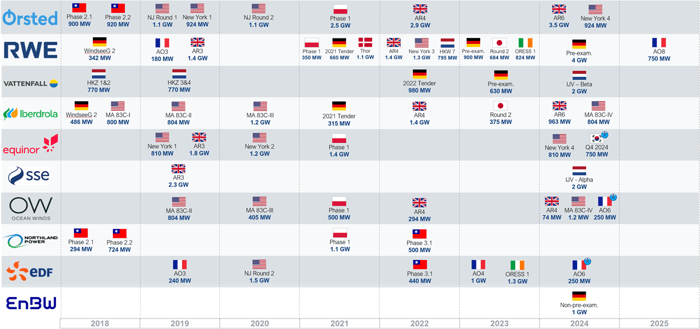

Figure 1: Auction activity among top 10 developers

“Auctions are the key battleground for offshore wind, with tough market conditions reshaping how costs and risks are shared between governments and developers. While stuttering auctions threaten energy targets, it’s encouraging to see governments stepping up as they recognize the need for offshore wind in their power systems,” said Patrick Owen, lead author of the report.

Packed with timely insights and detailed analysis, the latest Quarterly Market Overview Report, available to TGS | 4C subscribers, equips industry leaders with the knowledge to act decisively in a volatile offshore wind market. Subscribers gain access to forward-looking forecasts, in-depth policy tracking, supply chain risk assessments and exclusive data modeling trusted across the industry. From auction dynamics and floating wind progress to turbine manufacturing capacity and decommissioning forecasts, the report delivers a holistic view of the opportunities and risks shaping offshore wind’s future.

The full report is available exclusively to 4C Intelligence subscribers. Visit 4COffshore.com for more information or to request a copy.

TGS | 4C provides intelligence reports on offshore energy trends via its 4C Intelligence platform. As a division of TGS, a leading energy data and intelligence provider, it also offers consultancy services for offshore projects, including offshore wind, subsea power cables, telecommunications, pipelines, and geospatial IT and GIS services.

About TGS

TGS provides advanced data and intelligence to companies active in the energy sector. With leading-edge technology and solutions spanning the entire energy value chain, TGS offers a comprehensive range of insights to help clients make better decisions. Our broad range of products and advanced data technologies, coupled with a global, extensive and diverse energy data library, make TGS a trusted partner in supporting the exploration and production of energy resources worldwide. For further information, please visit www.tgs.com (https://www.tgs.com/).

For media inquiries, contact:

Bård Stenberg

IR & Business Intelligence

investor@tgs.com

Forward Looking Statement

All statements in this press release other than statements of historical fact are forward-looking statements, which are subject to a number of risks, uncertainties and assumptions that are difficult to predict and are based upon assumptions as to future events that may not prove accurate. These factors include volatile market conditions, investment opportunities in new and existing markets, demand for licensing of data within the energy industry, operational challenges, and reliance on a cyclical industry and principal customers. Actual results may differ materially from those expected or projected in the forward-looking statements. TGS undertakes no responsibility or obligation to update or alter forward-looking statements for any reason.