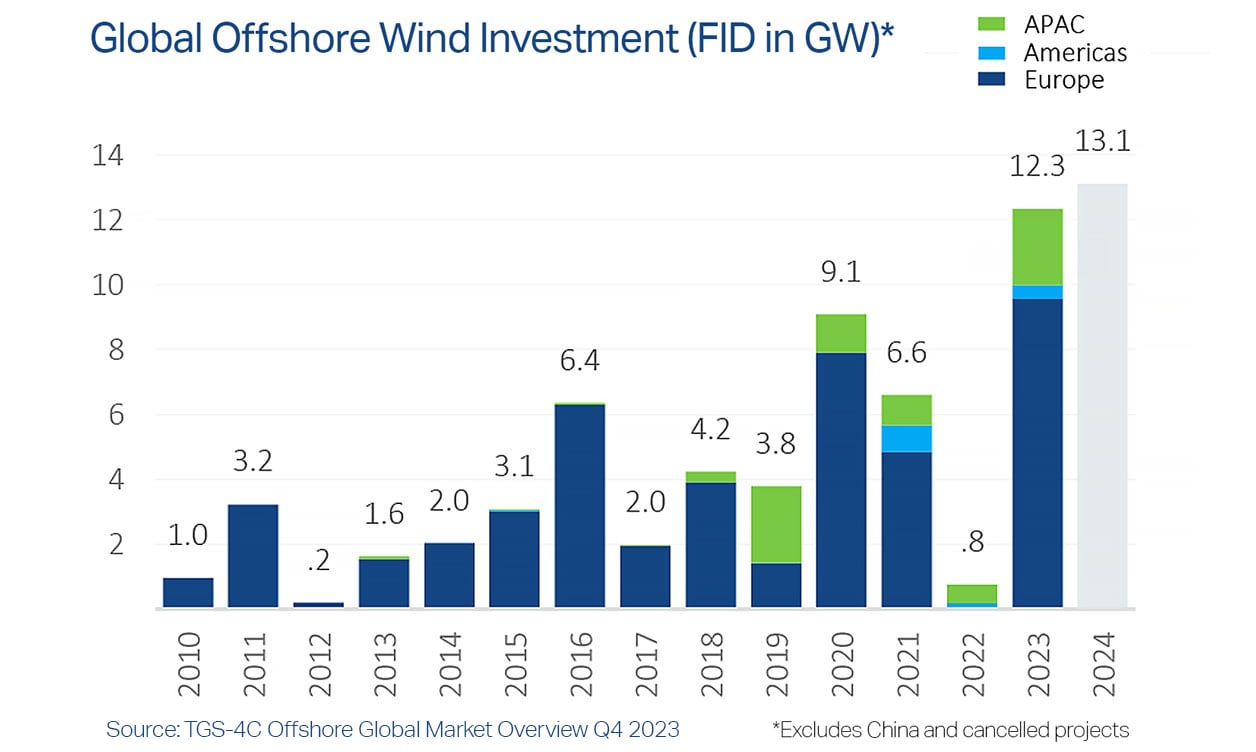

Lowestoft, U.K. (03 January 2024) – Offshore wind specialist TGS - 4C Offshore, a part of TGS, the leading global provider of energy data and intelligence, has declared 2023 to be a record year for offshore wind investment with projects totaling 12.3 GW having closed during the year. This represents a strong recovery from last year, when only 0.8 GW reached Final Investment Decision (FID). TGS – 4C Offshore's latest Global Market Overview also states that 2024 could be lining up to be another record year with up to 13 G.W. possible.

Final Investment Decisions were made by eight European projects in 2023, totaling 9.3 GW, with Hornsea closing just in time for Christmas. In Asia-Pacific, 2.3 GW closed across Taiwan and South Korea, and 704 MW in the USA at Revolution Wind.

Offtake Continues to Hit The Headlines

The U.S. is currently experiencing record offtake activity, with five auctions in process. Candidates include new and existing projects, vying for more favorable terms. Overall, offtake needs to make up ground, according to the report, which states that offtake contracts are down almost 2 G.W. to 9.5 GW in 2023, primarily driven by a no-show in the U.K.'s Contracts for Difference (CfD) auction.

However, of those offtake contracts that were awarded, the price is markedly higher than in previous years – an average of €105/MWh in 2023 - reflecting recent inflation, supply chain constraints and interest rates on the cost of energy. The experts behind the report expect offtake contracts to remain an area of focus over the next two years.

Richard Aukland, Director of Research at TGS - 4C Offshore, commented, "Despite ongoing project delays and cancellations, 2023 has still managed to produce record progress in offshore wind. With high activity and a significant year of offtake auctioning expected in 2024 as countries work to hit their 2030 installation targets, a positive scene is being set for the next twelve months, and this will translate into record construction activity later in the decade."

Record Lease Auction Activity in 2024

The offtake auction schedule continues to look healthy, with 47.5 GW slated for 2024 (40 G.W. in Europe), and it's a similar story for lease rounds with 33.5 GW of leases under the hammer, including in Australia, Belgium, Colombia, Denmark, Estonia, Finland, France, India, Japan, Lithuania, Netherlands, Norway, Portugal, Spain, the U.K., Uruguay and the U.S.. The rate of lease activity has ramped up in the last two years, with 43.8 GW-worth of sites awarded in 2023, one-third of which was for floating wind.

The report includes several other industry insights, including Market Indicators, which examine global additions, permitting, offtake, and timelines since 2010. These are used to identify trends to estimate for the year ahead. The latest Market Indicators show that with 879 GW accounted for by existing projects and national targets, a further 1,121 GW would still be needed to meet IRENA/IEA's estimated net-zero requirement of 2,000 GW by 2050.

The report also includes an exclusive deep dive into floating wind as part of a unique Market Attractiveness Index, which considers the most attractive floating wind markets. Once again, The U.K. comes out on top overall, followed by Norway. Other markets scoring highly include South Korea, which currently has the greatest perceived potential, and the U.S., which has the greatest ambition. However, 4C Offshore's forecast for floating wind underway by 2030 has been reduced for the 6th quarter in a row to 10 G.W. of capacity underway.

TGS - 4C Offshore releases regular intelligence reports on a wide variety of offshore energy subjects, including wind farms, construction & heavy maintenance, wind logistics, and Offshore Transmission and Cables. For more information, visit 4coffshore.com.

About TGS

TGS provides scientific data and intelligence to companies active in the energy sector. In addition to a global, extensive and diverse energy data library, TGS offers specialized services such as advanced processing and analytics alongside cloud-based data applications and solutions.

For media inquiries, contact:

Jaclyn Townsend

VP, Marketing

jaclyn.townsend@tgs.com