With permits up 93% since 2020, Niobrara poised to remain key driver of Powder growth

Last week, Three Crown Petroleum announced promising results from a recently completed Niobrara well in the Powder River Basin. The announcement follows a growing list of positive Niobrara results over the last year as larger companies like EOG, Oxy, and Devon continue to expand their footprints in the basin. Earlier this year, Continental stated that the Powder still has “several billion barrels of resources to be mobilized”, indicating it could be the next big resource play. This week, using TGS Well Data Analytics and Well Economics, we evaluate how a 90% jump in Powder Niobrara permit activity and a 11% rise in IP90s are driving production growth across the basin. We also analyze how increasingly efficient completion methods are reducing capex costs as breakeven prices for the Niobrara have dropped by over 20% YoY.

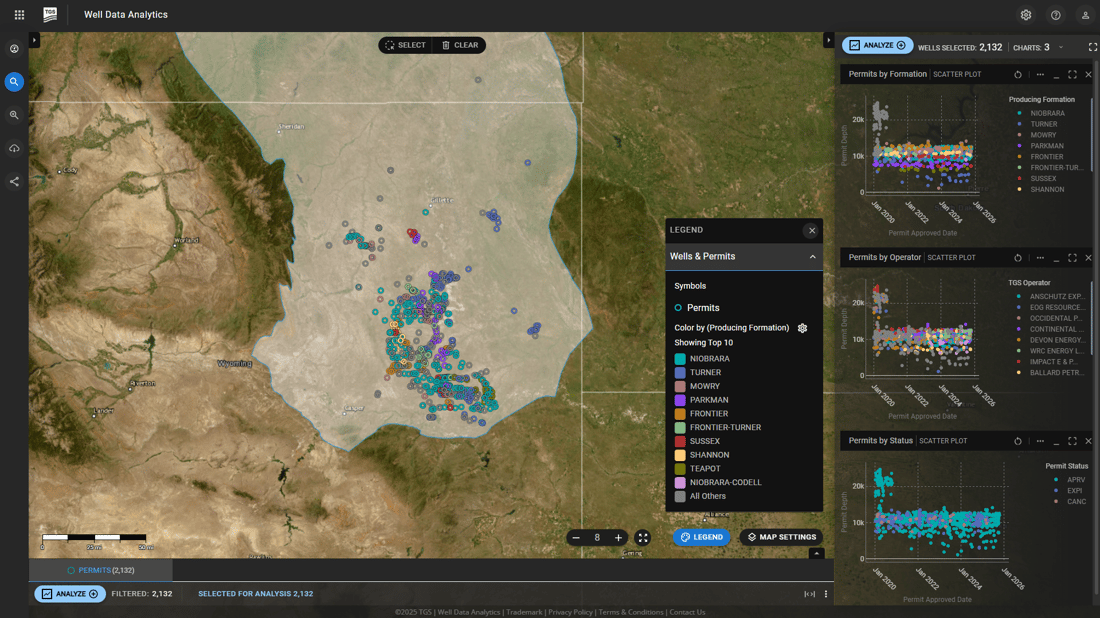

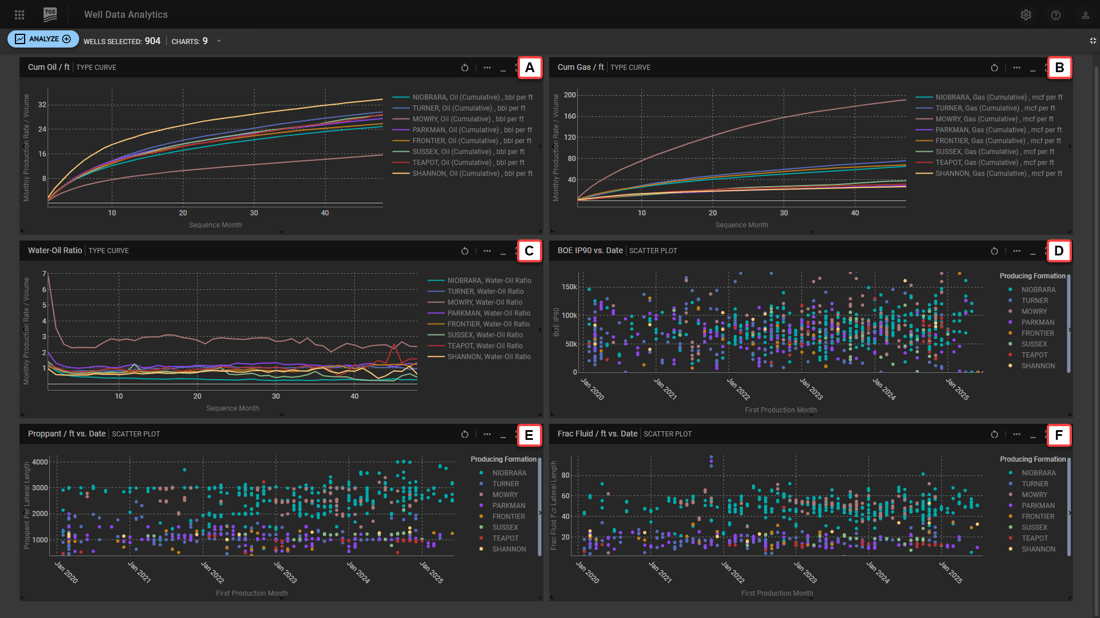

As we mentioned in our article earlier this year, according to TGS Well Data Analytics, Powder production has grown by 14% over the past 5 years to 381 MBOE/d, primarily driven by a 4-fold increase in Niobrara and Mowry production. Permit activity indicates this figure is expected to continue growing as Niobrara permits have climbed 93% over the past 5 years and is currently on track for a 5% YoY growth (Figure 1). As a result, Niobrara’s share of approved permits has more than doubled from 23% to 56% since 2020. The rise in Niobrara permits is likely due to increasingly positive well results, where BOE IP90s have grown by 11% YoY combined with the lowest water-oil ratio as compared to the other formations, indicating that newer wells are achieving higher peak rates and producing relatively small volumes of water (Figure 2). At the same time, lateral lengths have largely stabilized over the past year with 87% of new wells drilled since 2024 as 2-mi laterals, indicating leaner completion methods.

Alongside an increase in peak production rates, Niobrara completions have become much more efficient over the past five years with an 11% drop in proppant and 10% drop in frac fluid per foot of lateral length (Figure 2), translating to a 4% reduction in drilling and completion costs. As a result, according to TGS Well Economics over the past year, breakeven prices have dropped over 20% to $37 per BOE, which roughly equates to $60 per bbl and $3.34 per mcf. Although EIA estimates are projecting oil price to average $52 in 2026, the Powder Niobrara continues to show promise with YoY reductions in breakeven prices. With permit momentum showing no signs of slowing down, Powder production will continue to grow into 2026.

Using TGS Well Data Analytics, we were able to quickly evaluate permit activity, completion design, and economic performance. For more information about TGS Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figure 1. Overview of Powder River Basin permit activity (2020-2025)

Figure 2. Performance and completion design analysis of 2020-2025 Powder wells including: A) Cum Oil/ft, B) Cum Gas/ft, C) Water-Oil Ratio, D) BOE IP90, E) Proppant/ft, and F) Frac Fluid/ft.