Antero’s $2.8 billion acquisition caps off busy M&A year for Marcellus Assets

Last week, Antero Resources announced a $2.8 billion acquisition of HG Energy’s Marcellus assets while simultaneously divesting its Utica assets for $800 million. The move caps off a busy year for Marcellus M&A activity including deals such as EQT’s $1.8 billion acquisition of Olympus Energy in 2Q and CNX’s $505 million acquisition of Apex in 1Q, as operators build inventory to meet rising demand from AI data centers. In 2Q, EQT signed a 10-year 1.2 bcf/d supply agreement with Duke Energy and Southern Company ahead of the anticipated AI power demand boom, that is projected to require Appalachia demand to grow by 6-7 bcf/d or 15-17% by 2030. According to TGS Well Data Analytics, the Marcellus is in a prime position to meet increasing natural gas demand with permits rising 26% over the past year coupled with a rise of 3% in productivity per foot of lateral length.

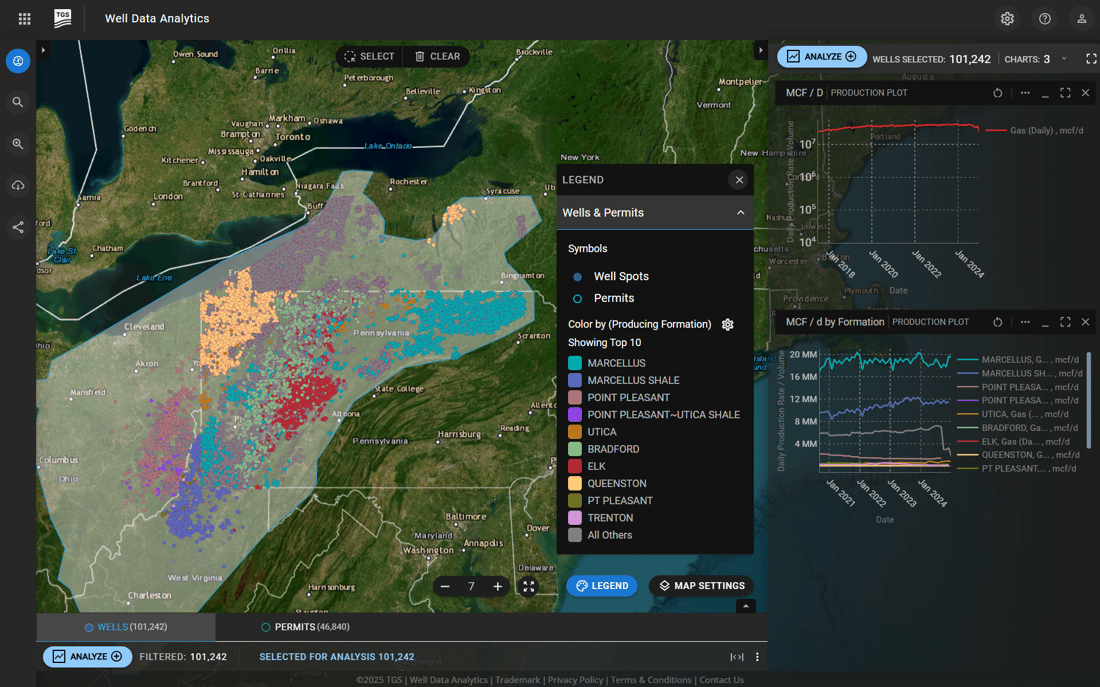

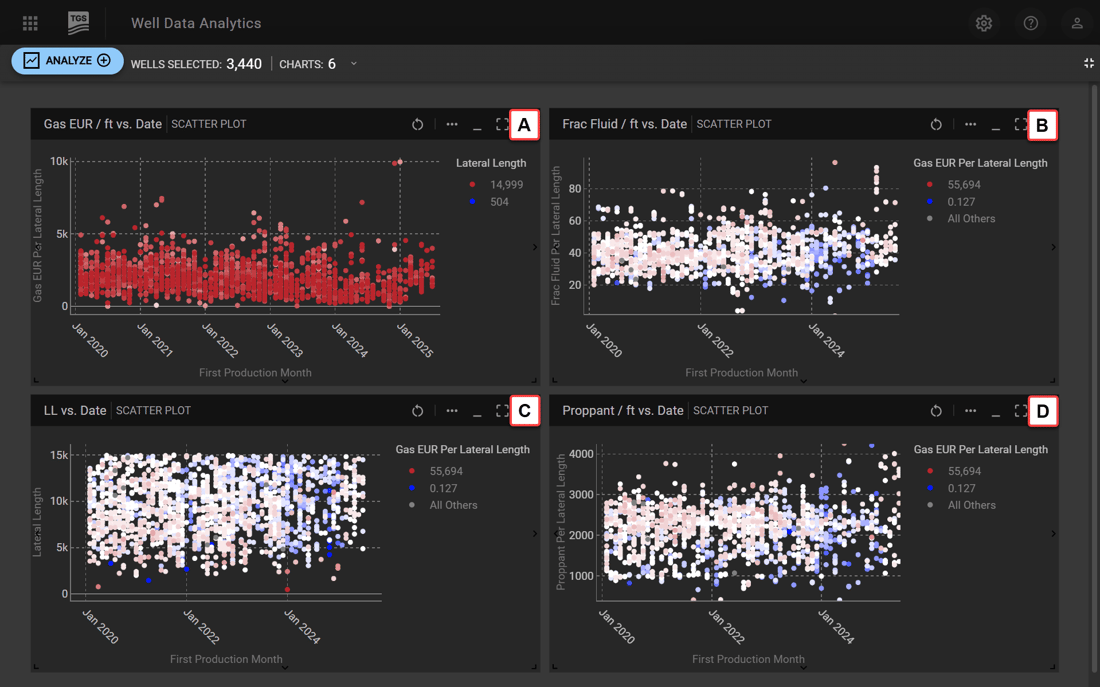

In 2024, total Appalachia gas production averaged nearly 40 bcf/d, a 10% rise in daily production since 2020 (Figure 1). Over the same period, Marcellus production rose by 11%, increasing its share of Appalachia production by 2% to over 30 bcf/d. The increase is largely due to a rise in productivity where estimated ultimate recoverable (EUR) gas per foot of lateral length rose by 3% in the last 5 years (Figure 2). At the same time, operators have also increased lateral lengths by nearly 14% in the same period, driving the total EUR per well by 7%, indicating the largest productivity gains are coming from shorter laterals. While the lateral lengths have increased, proppant loads and frac fluid amounts per foot of lateral length have also increased by 34% and 27%, respectively. Although the overall increase in drilling and completion (D&C) materials drives up capex, the breakeven continues to drop due to the efficiency gains from per ft productivity with over a 50% reduction in the median breakeven price over the past 5 years to $1.64 mcf in 2025.

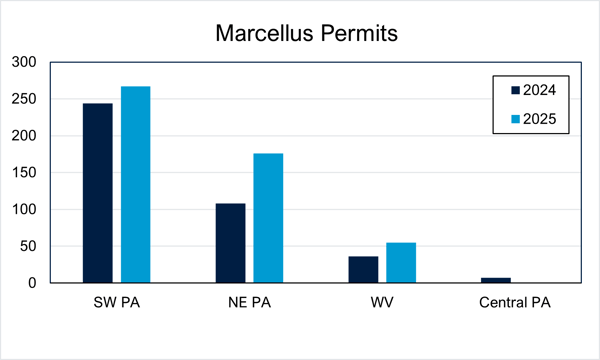

Recent productivity gains have also spurred Marcellus permit growth over the past year with approved permits jumping 26% across West Virginia (WV) and Pennsylvania (PA) (Figure 3). The largest percentage increases have occurred in WV & NE PA at 53% and 63%, respectively, likely due to less M&A activity versus SW PA. Newly drilled wells are expected to enter a more favorable pricing environment where natural gas is projected to average $4/mcf in 2026, up from its 3-year average of $2.73/mcf. According to TGS Well Economics, this increase could reduce discounted cash flow (DCF) payback periods for individual wells by 70%. Going forward, momentum for the Marcellus could continue to build due to a stronger pricing environment coupled with more productive wells.

For more information about TGS Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figure 1. Overview of Appalachia Basin Activity (2020-2025).

Figure 2. Performance and completion design analysis of 2020-2025 Marcellus wells including: A) gas EUR / ft, B) frac fluid / ft, C) lateral length / ft, and D) proppant / ft

Figure 3. Marcellus approved permits by region (2024-2025).