Permian Resources’ $4.5B Earthstone Energy merger will shape the future of the Permian Basin.

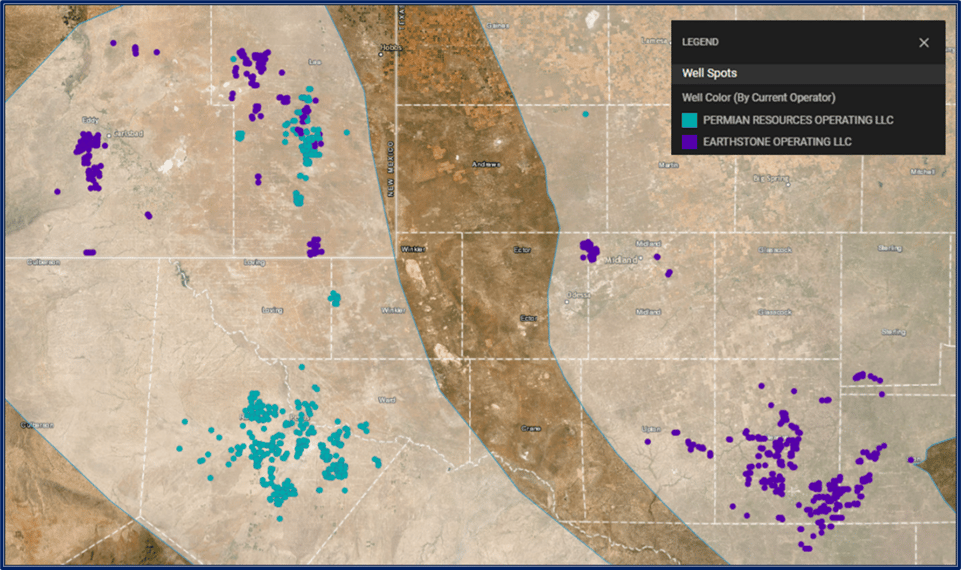

Permian Resources announced the acquisition of Earthstone Energy’s Permian Basin assets for $4.5 billion, which significantly scales Permian Resources’ acreage to more than 400,000 net acres1. The combined entity will produce approximately 300,000 barrels of oil equivalent per day in the Permian Basin. The acquisition propels the company’s pro forma market capitalization to approximately $10 billion and positions them as the third-largest pure-play Permian exploration and production (E&P) company following Pioneer Natural Resources and Diamondback Energy.

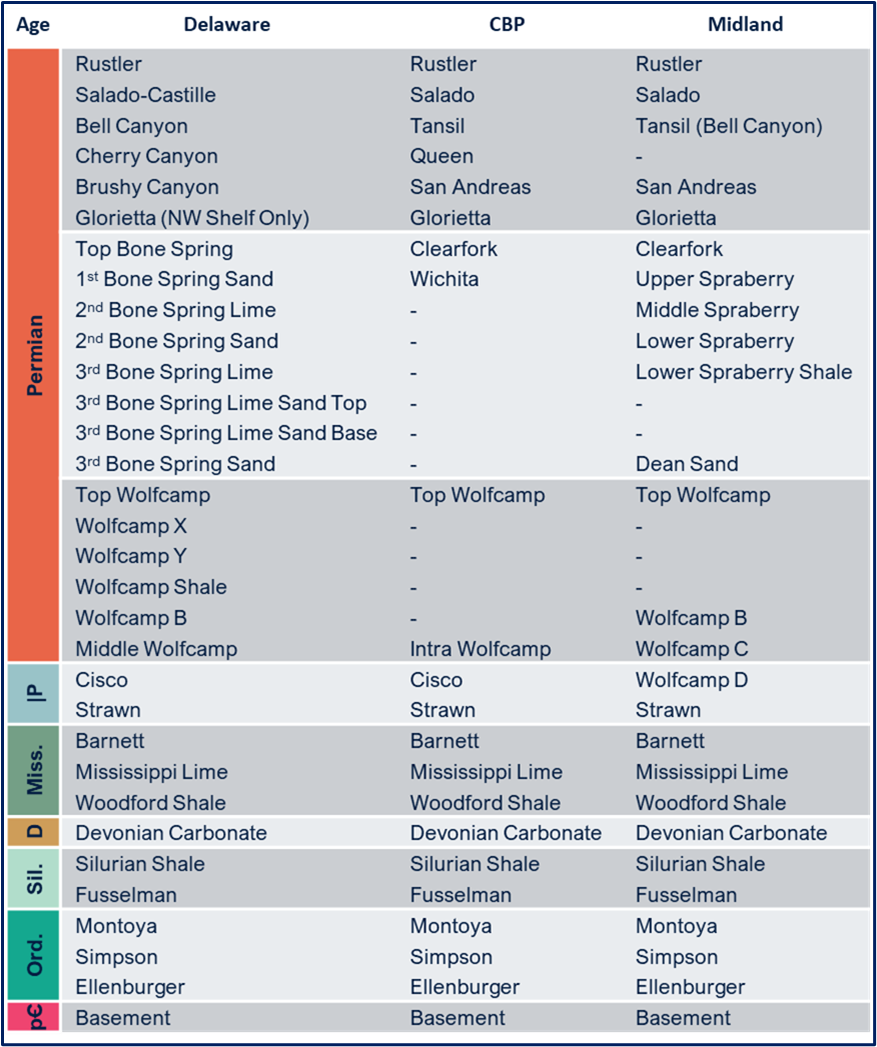

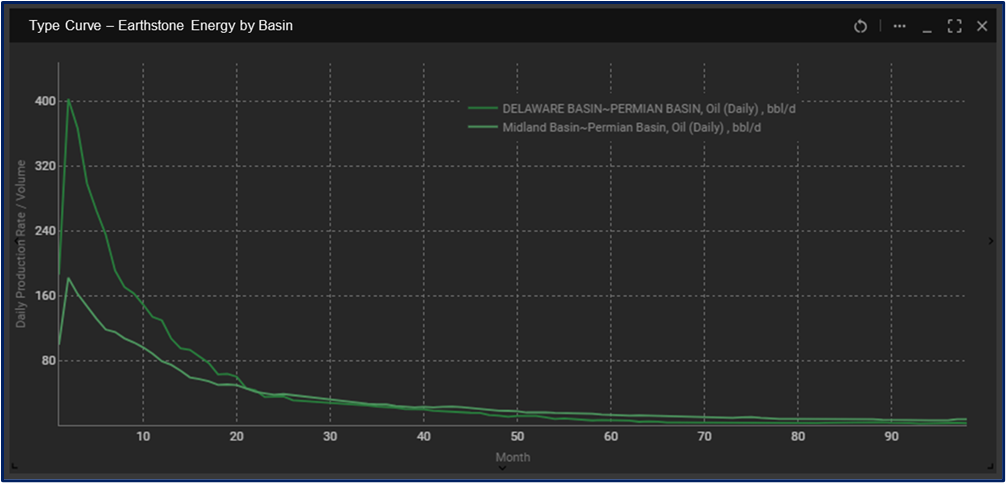

Following the merger, Permian Resources aims to allocate 90% of its capital spending to Delaware Basin projects utilizing Earthstone's Midland Basin assets for free cash flow generation, which will then be reinvested into high-return Delaware Basin projects. Investigating Earthstone Energy’s production trends and targeted formations in comparison with Permian Resources using TGS’ Well Data Analytics and Permian Basin Stratigraphic Model2, Earthstone’s production mainly targets the Wolfcamp X and 2nd Bone Spring Sand, whereas Permian Resources targets the Wolfcamp Shale and Top Wolfcamp (Wolfcamp A equivalent), Delaware Basin. Earthstone’s Midland Basin assets mainly target the Wolfcamp B and A. Analyzing Earthstone Energy’s oil production by basin, Delaware assets produce approximately 80 BOE per lateral foot where Midland assets produces 60 BOE per lateral foot3.

For more information on TGS Stratigraphic Models, Well Data Analytics or to schedule a demo, contact us at WDPSales@tgs.com.

Figures:

1Map of Permian Resources and Earthstone Energy assets in the Delaware and Midland Basins. Figure created using TGS Well Data Analytics.

2TGS Permian Stratigraphic Model formation tops.

3Oil type curve for Earthstone Energy assets in the Delaware and Midland Basins. Figure created using TGS Well Data Analytics.